Indo-US deal: Not just a tariff reset

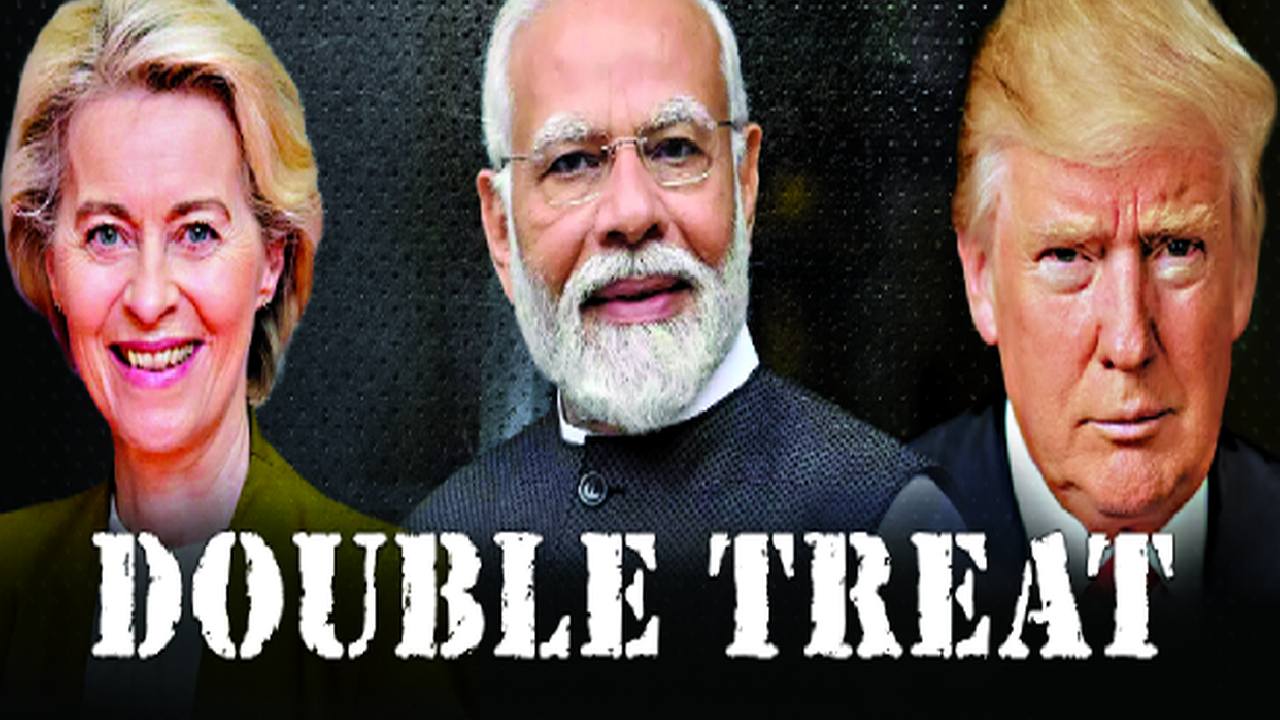

The global economic order is currently witnessing its most significant reconfiguration since the end of the Cold War. Coming close on the heels of the India-EU Free Trade Agreement, the India-US trade agreement announced recently marks a decisive break from years of episodic, tactical trade negotiations. Small wonder, then, that this agreement is being seen as a defining moment, resetting a period of tariff escalation, reviving India’s export momentum, and reframing engagement between the world’s two largest democracies. At its core, the deal is not merely about tariff rationalisation; it is about confidence, market access, and re-anchoring India’s global trade narrative in a fractured geoeconomic order.

The proposed reduction of US tariffs on Indian exports to around 18 per cent, down from a punitive level of 50 per cent, positions India among the least-tariffed nations exporting to the US. It sends a clear signal to global markets: India and the United States are prepared to anchor their economic relationship in stability, mutual interest, and long-term partnership rather than retaliatory trade posturing.

Markets responded swiftly. Indian equities recorded their strongest weekly performance in nearly three months following the announcement, while the rupee posted its best weekly gain in over three years. These moves underscored a global reset in perceptions of India’s trade prospects, external stability, and capital flows.

It is important to emphasise that the formal text of the agreement and the implementation schedule will determine the real economic outcomes. India’s Commerce Minister has indicated that a joint statement is imminent, and that the first phase of the bilateral trade agreement could be formally signed by mid-March 2026.

Beyond Tariffs: Why This Deal Matters Strategically

The US is India’s largest goods export destination, accounting for 21 per cent of total exports. The tariff reduction significantly improves price competitiveness for labour-intensive sectors such as textiles, apparel, and gems and jewellery.However, the real significance of the agreement lies not in tariff arithmetic but in strategic intent. Trade is being repositioned as an enabler of technology collaboration, supply-chain resilience, and geopolitical alignment. In a world where global supply chains are being redrawn away from excessive concentration, India’s value proposition as a large market, a manufacturing base, and a trusted partner has gained renewed credibility. For the US, the deal reinforces India’s role as a dependable economic and strategic counterweight in Asia. For India, it creates space to integrate more deeply into high-value global value chains without compromising domestic priorities. This agreement reflects a shift from transactional trade negotiations to a strategic economic partnership. That shift, if sustained, could prove more consequential than any single tariff concession.

Manufacturing and Export-Led Sectors

Labour-intensive and export-oriented sectors stand to benefit most. Textiles, apparel, engineering goods, chemicals, and gems and jewellery - segments that suffered most from the prior tariff escalation — now regain pricing headroom in the US market. For Indian manufacturers, especially MSMEs, who contribute nearly 45 per cent of India’s total exports, this improves order visibility and capacity utilisation at a time when global demand remains subdued.

Solar equipment and clean-tech manufacturers also emerge as important beneficiaries. With tariffs eased and policy alignment improving, Indian firms can expand exports while supporting the broader energy-transition agenda, an area of increasing convergence between New Delhi and Washington.

Agriculture and Agri-Exports

Agriculture and dairy remain politically sensitive. The agreement appears to have taken a calibrated approach: protecting core domestic interests while selectively opening export opportunities. Products such as basmati rice, processed foods, edible oils, and marine exports could see incremental gains without exposing Indian farmers to destabilising import competition. This balance will be critical to sustaining domestic support for trade liberalisation.

Energy, Technology and Strategic Imports

Donald Trump has stated that India will buy over $500 billion worth of US goods. While the details are awaited, increase in India’s purchases from the US over the coming years will primarily be energy, technology, and defense equipment. While the transition from discounted Russian crude to US energy sources poses a short-term cost challenge (potentially adding $8-12 billion to the annual energy bill), it aligns with India’s long-term objective of ensuring energy security, by diversifying energy suppliers. More importantly, it embeds energy security within a broader strategic relationship rather than treating it as a purely commercial transaction.

The real opportunity lies in technology, defence manufacturing and high value industrial goods, as engagement shifts from contract manufacturing to co-development anchored in iCET ( Initiative on Critical and Emerging Technology) and the co-creation of IP. India’s ascent as the largest smartphone exporter to the U.S. signals a decisive shift up the value chain and Indian firms will increasingly look to partner and jointly innovate with U.S. across AI, semiconductors, electronics and space.

Execution Is the Real Test

As with all major trade agreements, the announcement is only the beginning. Until the actual agreement text is published, questions remain on scope, schedules, exclusions, and dispute resolution mechanisms.

The success of this deal will depend on three critical factors.

First, clarity of execution. Businesses trade on certainty, not intent. Detailed timelines, sector-specific schedules and transparent rules of origin will determine whether exporters and investors can actually act on the opportunity.Second, regulatory coherence. Trade gains can be diluted quickly if domestic regulatory frictions around compliance, logistics, taxation or standards are not addressed in parallel. The deal must be complemented by domestic reforms that lower transaction costs for Indian firms.

Third, strategic consistency. This agreement should not remain a standalone event. It must be embedded within India’s broader industrial, technology and export strategy, linking Make in India with global market access, and aligning trade policy with long-term capability building.

A Confidence Signal, Not a Silver Bullet

The India-U.S. trade deal is a consequential pivot in bilateral economic relations with far-reaching implications for markets, manufacturing, and strategic alignment. Its success will not be judged by announcements or tariff lists but by growth outcomes, investment flows, and the degree to which Indian exporters and innovators translate global access into industrial resurgence.

The India-U.S. trade deal will not, by itself, transform India’s export profile or eliminate structural challenges. But it does something equally important: it restores confidence.

Confidence that India will remain integrated with global markets even amid geopolitical churn. Confidence that trade policy will be guided by pragmatism, rather than ideology. And confidence that India can pursue growth, competitiveness and strategic autonomy simultaneously.

If implemented with discipline and foresight, this agreement can catalyse investment, improve productivity, and generate high-quality jobs supporting India’s journey towards a globally competitive economy and realizing the long-term vision of Viksit Bharat 2047, while anchoring India as a dependable partner in global trade and geopolitical stability.

In today’s fractured global economy, that rare combination of ambition, execution and balance may prove to be the deal’s most enduring achievement.

Santanu Sengupta is a Board Leader and Strategic Advisor, and former Managing Director at Wells Fargo Bank with three decades of leadership experience in global banking, risk management, strategy and transformation.