Power sector: A turning point

The year 2025 will be remembered as a decisive moment in India’s power sector not because of a single policy announcement or a headline-grabbing capacity milestone, but because it marked a deeper shift in national thinking. India’s electricity transition has moved beyond the simpler question of how much power the country can generate to a far more complex and consequential challenge: how reliably, flexibly and intelligently the power system can be managed. Over the past decade, India has built one of the world’s most ambitious renewable energy programmes. Installed electricity capacity is now approaching 500 GW, and non-fossil sources crossed the 50 per cent mark well ahead of the COP26 commitment. On paper, these numbers inspire confidence.

Yet 2025 exposed a critical structural reality. Despite massive renewable additions, coal continues to supply nearly three-fourths of actual electricity consumption. The growing gap between installed capacity and dependable, round-the-clock supply has become the central issue of India’s power transition. This gap is rooted in the very nature of renewable energy. Solar generation peaks during midday hours and falls sharply after sunset, while wind power varies across seasons and regions. As renewable penetration rises, these fluctuations increasingly stress the grid, leading to price volatility, curtailment of clean power and operational complexity for system operators. The events and experiences of 2025 made it unmistakably clear that the next phase of India’s energy journey is no longer about generation alone — it is about system design. One of the most significant shifts during the year was the transition of energy storage from a policy aspiration to a practical necessity. Storage is no longer treated as an optional add-on to renewable projects; it is now recognised as core grid infrastructure. A defining moment was the Solar Energy Corporation of India’s tender for 1.2 GW of renewable capacity bundled with 4.8 GWh of battery storage.

The message was clear: future renewable growth in India will be inseparable from storage. Energy storage allows the grid to absorb surplus renewable power and release it during periods of high demand. Short-duration batteries help manage daily variability, while long-duration solutions — such as pumped hydro, flow batteries and, eventually, green hydrogen-based storage — will be essential for seasonal balancing. Yet storage remains capital-intensive, and investor confidence depends on policy clarity. What India now needs is not sporadic mega-auctions, but a steady, predictable pipeline of storage-linked tenders. Policy continuity will be critical to building domestic manufacturing capacity and driving costs down. At the same time, 2025 underlined a profound transformation on the demand side. India’s fast-expanding digital economy is creating a new class of electricity consumers — data centres and AI-driven infrastructure. Hyperscale data centres are clustering around Mumbai, Chennai and Hyderabad, and by 2030 they are expected to add nearly 5-6 GW of continuous power demand. Unlike traditional consumers, data centres operate 24/7 and are acutely sensitive to power quality. Even brief voltage fluctuations can disrupt operations. This changes the planning paradigm for utilities and policymakers. The objective can no longer be limited to meeting peak demand.

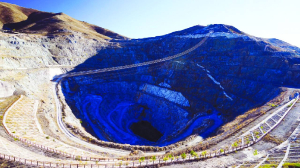

Instead, the grid must deliver uninterrupted, high-quality power at all times. Achieving this requires stronger transmission networks, reinforced substations, advanced automation and real-time digital monitoring. Data centres are also accelerating the sustainability agenda. Many operators have net-zero commitments and are actively procuring green power through renewable power purchase agreements, placing new responsibility on utilities to ensure credible scheduling, wheeling and verification of clean energy. Transmission infrastructure - often overlooked in public debate — has emerged as the silent enabler of the entire transition. India invested around INR 2.5 lakh crore in transmission over the past five years, and planned investments up to 2030 are even larger.

High-voltage corridors, including HVDC links, are essential to move renewable power from resource-rich regions to demand centres and to balance variability across states. Without adequate transmission, neither renewable capacity nor storage can deliver their full value. Another clear lesson from 2025 is the strategic importance of domestic manufacturing. Local production of transformers, switchgear and high-voltage equipment reduces supply-chain risks, shortens delivery timelines and strengthens system resilience. Companies that have invested in Indian manufacturing are better positioned to support rapid grid expansion while also contributing to exports and employment. Sustainability itself has matured. The focus has shifted from intent to outcomes. Technology providers and utilities are increasingly judged by measurable progress - emissions reduction, clean energy use and resource efficiency. This evolution is essential, because a net-zero power system must be built by organisations that are themselves transitioning responsibly. Looking ahead to 2030, India’s success will not be defined solely by reaching 500 GW of renewable capacity. True success means reliable, affordable, continuous power delivered through a flexible, digital, well-integrated grid. The year 2025 showed that India’s energy transition has entered its most demanding phase. Ambition brought the country this far; the future will be decided by execution — at system scale.

Rajib K Mishra is a power sector expert and former CMD, PTC India; views are personal

Leave a Comment

Comments (1)

Decentralised connected microgrids can reduce transmission infra capacity required