Defence budget: Time to strive for strategic sovereignty

As India prepares Budget 2026, the defence sector stands at a pivotal inflection point. Years of policy intent around self-reliance must now translate into industrial depth, technological ownership, and export competitiveness. The recommendations emerging from recent policy thinking suggest a decisive shift-from assembling foreign platforms in India to owning intellectual property, from episodic procurement to modular upgrades, and from state-dominated production to a genuinely collaborative public-private ecosystem. If implemented with fiscal backing, Budget 2026 could redefine India’s defence-industrial trajectory.

At the heart of this transformation lies the proposed Defence Production Manual (DPM) 2025. Expected to supersede earlier “Make in India” frameworks, the DPM signals a conceptual shift from import substitution to sovereignty. Past acquisition programmes relied heavily on licensed production, with limited absorption of design capability. The new framework is likely to mandate that indigenisation be measured not merely by where a product is manufactured, but by who owns the design and intellectual property.

This is a critical correction. Without indigenous design, India remains vulnerable to supply shocks, export controls, and geopolitical pressure. A chronic weak link in indigenisation has been the Tier-2 and Tier-3 supplier base, largely composed of MSMEs. The anticipated ‘cluster approach’ under DPM 2025-linking large prime contracts to mandatory MSME sourcing within defence industrial corridors-can help address this. However, clusters will not mature on policy intent alone. Budget 2026 must provide enabling incentives: accelerated depreciation on specialised machinery, GST rationalisation, and targeted credit support for MSMEs entering defence supply chains. Equally important is funding for design capability. The proposed Defence Modernisation Fund and government support for 70-80 per cent of prototyping costs, against shared IP, can de-risk private investment in long-gestation technologies such as aero-engines and advanced materials.

Public-Private Partnerships (PPPs) form the second pillar of reform. Defence manufacturing is capital-intensive and cyclical, making pure private investment risky.

A refined PPP model, backed by budgetary support, can balance efficiency with stability. The Government-Owned, Company-Operated (GOCO) model is an obvious low-hanging fruit for ammunition factories and repair depots, reducing costs while improving quality. For strategic systems like the Advanced Medium Combat Aircraft or nuclear submarines, Special Purpose Vehicles that pool DRDO’s design strengths, DPSU infrastructure, and private-sector supply chains offer a pragmatic solution. Budgetary provision allowing the Ministry of Defence to take equity stakes in such SPVs would effectively position the state as a venture capitalist in its own industrial base. Leasing and service-based models-paying for availability rather than ownership-can further enhance operational efficiency while smoothing capital expenditure.

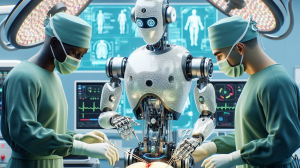

Technology and R&D investment must underpin all these efforts. India’s defence R&D spending, still below 1 per cent of GDP, needs sharper targeting. Modern warfare is data-intensive; investments in AI-enabled decision-support systems, high-fidelity simulators, cybersecurity, and space capabilities directly enhance human productivity and operational readiness. Scaling up the iDEX initiative and earmarking a meaningful share of R&D funds for start-ups and academia can democratise innovation. Defence Innovation Hubs within academic institutions can create a steady pipeline of mission-ready talent while keeping costs contained. Procurement reform is equally crucial. The era of ‘big bang’ acquisitions is increasingly untenable. Modular acquisition-buying open-architecture platforms with periodic upgrades-allows India to keep pace with technological change while smoothing budgetary outflows. Moving beyond the rigid L1 system towards Quality and Cost-Based Selection for high-technology platforms would prioritise lifecycle value over short-term savings, improving reliability and accountability. Finally, exports must be treated as a strategic instrument, not an afterthought.

The INR 50,000 crore defence export target by 2029 is achievable only if financing and regulatory bottlenecks are addressed. A dedicated corpus for defence lines of credit through EXIM Bank and a fully digital, single-window export clearance system can help Indian platforms compete with Chinese offerings in Africa, Southeast Asia, and the Indian Ocean Region. In sum, Budget 2026 has the opportunity to anchor India’s defence ambitions in fiscal reality. By aligning indigenisation with design sovereignty, de-risking private participation, prioritising high-impact R&D, and treating exports as a strategic lever, India can move decisively from being a major arms importer to a credible global defence manufacturing power. The challenge is no longer intent-it is execution and coherence.

The authors are advisor and research analyst at CRF.This article is taken from the Pre-Budget Booklet compiled by the Chintan Research Foundation (CRF).; views are personal