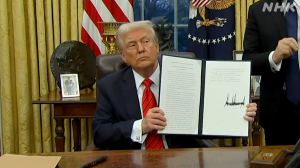

Dealing with Indo-US trade deal

The interim trade framework between the largest economy in the world, the USA, and the fastest-growing economy, India, is set to be a game-changer and a historic trade deal. It marks an initial step towards a Bilateral Trade Agreement (BTA) between the two major economic powers. The framework will boost exports from labour-intensive Indian sectors such as textiles, footwear, plastics and smartphones. The India-US trade deal will cut tariffs on 60per cent of Indian exports to the US and includes provisions for zero tariffs on multiple items entering the US market. This will provide India access to the $30 trillion US market with lower tariffs than competing countries.

India will gain a competitive edge as the US has lowered tariff rates from a peak of 50 per cent to 18 per cent on Indian exports. In comparison, tariffs on China stand at 34 per cent, South Korea 25 per cent, Bangladesh 20 per cent, Vietnam 20 per cent, and Indonesia, Malaysia and Thailand 19 per cent. The US has effectively reduced tariffs by 32 per cent on Indian exports. Zero duties on selected products will enhance India’s export competitiveness. The move reflects market-reopening measures aimed at strengthening economic cooperation and trade relations between the two nations.

The broader framework will deepen economic engagement between India and the US. Several products exported from India — including spices, tea, coffee, gems and jewellery, diamonds and pharmaceuticals — will enjoy zero duty access. Around $44 billion worth of Indian merchandise exports are expected to gain this benefit. This will strengthen India’s position in global trade and accelerate its role in emerging sectors such as artificial intelligence (AI), hardware and compute ecosystems. Over the next decade, India could attract nearly $80 billion in AI-related investments, further establishing itself as a global hub in this domain. The agreement is expected to unlock the $120 billion US textile market for Indian exporters. With lower tariffs compared to competitors such as Bangladesh, Pakistan and China, India will gain a distinct advantage. A 50-60 per cent increase in textile exports to the US market is anticipated in the coming years.

India remains heavily dependent on imported crude oil, with nearly 85 per cent of demand met through imports. Diversifying supply sources has been a strategic priority. Imports from Russia have risen significantly in recent years. Under the trade framework, India is also expected to accelerate crude oil imports from Venezuela, potentially enhancing energy security.

The announcement of the framework has boosted investor confidence. India has emerged as a preferred destination for foreign institutional investors, with a noticeable rise in investment inflows. Both nations are working towards achieving Mission 500 — a target of $500 billion in bilateral trade by 2030. The deal is also aligned with India’s Viksit Bharat Mission 2047. India’s GDP, currently around $4 trillion, is projected to reach $35 trillion by 2047, making high-quality manufacturing and service delivery critical for sustained growth. Agriculture and food exports are likely to benefit significantly. While US agricultural exports to India stood at $2.25 billion, India’s exports to the US reached $6.2 billion. This figure is expected to cross $10 billion soon. In FY25, India imported $45.62 billion worth of US goods while exporting $86.5 billion to the US. Total bilateral trade stood at $132 billion, with India enjoying a $41 billion surplus. The US remains the third-largest investor in India, contributing around $70 billion between 2000 and 2025.

India has prioritised protecting sensitive sectors such as agriculture and dairy, including wheat, rice, milk and cheese. The textile and apparel sector remains a crucial contributor to exports. With zero-duty access to a $130 billion US market, India will benefit from lower tariffs compared to competitors like China, Bangladesh, Vietnam and Pakistan. The global textile market, valued at $900 billion, is expected to exceed $1.4 trillion by 2030. India currently holds a 4 per cent share, compared to China’s 40 per cent and Bangladesh’s 8 per cent. With exports of $37 billion last year, the sector aims to reach $100 billion by 2030.

The deal will also strengthen India’s performance in gems and jewellery. Indian exporters will gain access to a $60 billion US market with zero duty on diamonds and platinum. This provides an advantage over competitors such as South Africa (30 per cent), China (30 per cent) and Thailand (19 per cent). India will also gain improved market access in footwear and leather ($42 billion), toys ($18 billion) and machinery and parts ($480 billion). India has not committed to purchasing $100 billion annually from the US for five years. Instead, it has expressed intent to increase imports worth $500 billion over five years in energy, ICT, coal, aircraft and related sectors.

However, tariff relief remains temporary and conditional. While US tariffs have been reduced from 53 per cent to 18 per cent, earlier MFN status provided rates as low as 3 per cent. The US is also urging India to reduce dependence on Russian crude oil, which currently accounts for 35 per cent of India’s imports worth $50 billion in FY25. India saves around $2 billion annually through discounted Russian oil, while the US accounts for $87 billion (20 per cent) of India’s exports.

Despite these complexities, the interim framework is poised to reshape India’s export trajectory and pave the way for a comprehensive bilateral trade agreement between the two economic giants.

The writer is an Economist and National Media Panelist, Faculty — NMIMS University; views are personal