The solution doesn’t lie in more sops, fiscal incentives and so on. There is need for change in the way our industrialists do business and netas and babus conduct themselves

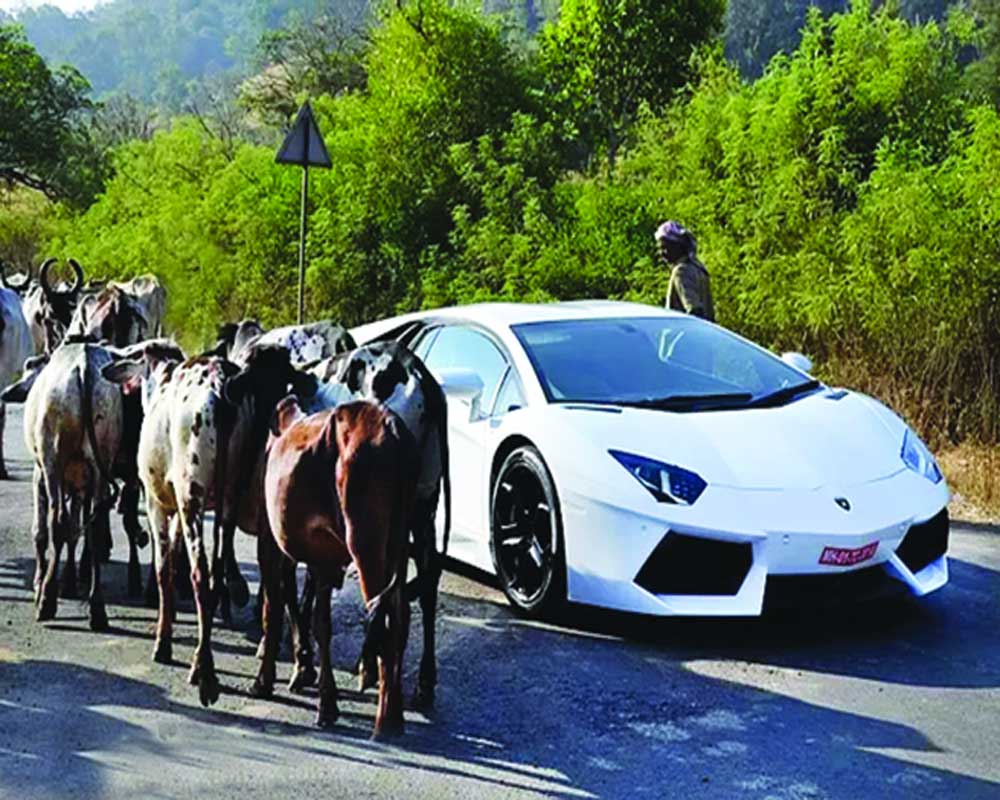

Successive Governments have remained obsessed with accelerating economic growth without caring about how it impacts income distribution, forget any attempt to internalise this crucial aspect in development strategies. They believe that the fruits of growth will automatically percolate to the lowest strata of society. Nothing could be farther from the truth. This is evident from a piece of research, Time to Care, released by rights group Oxfam ahead of the 50th Annual Meeting of the World Economic Forum (WEF) held in Davos (Switzerland) from January 21-24. According to the study, India’s richest one per cent hold more than four-times the wealth held by the 953 million people who make up the bottom 70 per cent of the country’s population. Further, the combined total wealth of 63 Indian billionaires is higher than the total Union Budget of the country for the fiscal year 2018-19.

At the global level, too, the report (for calculations, it draws upon latest data sources available, including the Credit Suisse Research Institute’s Global Wealth Databook, 2019 and Forbes’ 2019 Billionaires List) brings out glaring inequalities in the distribution of wealth. The world’s 2,153 billionaires have more wealth than the 4.6 billion people who make up 60 per cent of the planet’s population. The 22 richest men in the world have more wealth than all the women in Africa. The report notes, “global inequality is shockingly entrenched even as the number of billionaires has doubled in the last decade”.

The Governments world over are fully aware of these glaring inequalities as well as their consequences. For instance, the WEF’s annual Global Risks Report (GRR) — which was thoroughly discussed during the brainstorming sessions at Davos — observes, “inequality underlies recent social unrest in almost every continent, although it may be sparked by different tipping points such as corruption, constitutional breaches or the rise in prices for basic goods and services”. It also warned, “the downward pressure on the global economy from macroeconomic fragilities and financial inequality continued to intensify in 2019.”

They also routinely pledge to address these inequalities and come out with lofty declarations at multilateral platforms, including those under the auspices of the United Nations to bridge the gap between the rich and the poor, including by use of what the GRR terms as “deliberate inequality-busting policies.” Yet, when it comes to action on ground zero, there is acute lack of political will on the part of Governments and other stakeholders; hence, the business as usual scenario and ever-increasing inequities.

Fundamentally, inequalities are intrinsic to the way businesses are planned and orchestrated. It all starts with the Government offering a policy environment in which investors are offered an opportunity to earn an attractive rate of return on investment. What that attractive rate should be is not normally defined (though in certain sectors like power, it guarantees a minimum return); so any level, howsoever high, can fall within the scope of “attractiveness.” A vast majority of the businesses pursue the famous adage “profit maximisation” to the hilt. They distribute their expenses in such a manner that the least amount is given to the labour and the bulk of it comes back to the owner (or promoter) as “retained earnings.” The owners/promoters also leave no stone unturned in ensuring that their tax liability is kept at a bare minimum (for this, they retain the best talent viz. chartered accountants and other financial wizards, paying them extraordinarily high salaries). Big businesses also enjoy pricing power. For instance, those operating in metals such as copper, zinc or in hydrocarbon viz. oil and gas enjoy natural monopoly. Leveraging this, they charge high prices, making windfall gains even as consumers suffer erosion in purchasing power. This also applies to banks who enjoy margins of three-four per cent (difference between the average interest earning and the average cost of funds) yielding mammoth profit. Furthermore, there are companies in the IT (information technology) and IT-enabled sector which use their intellectual prowess to post huge profits year-after-year.

Then, there are enterprises in the chemical, petrochemicals and agrochemicals sectors who have hugely benefitted from a protective policy environment, with high tariff on imports as well as licensing and registration requirements. These companies make money at the expense of millions of consumers, including farmers (for instance, they have to pay a high price for “new” crop protection solutions for which domestic substitutes are not available).

The micro, small and medium enterprises (MSMEs) may not be so well positioned vis-a-vis large enterprises but ape the latter when it comes to distributing the proceeds of wealth generation. Their owners spend the least on payment to workers thereby boosting their retained earnings. They, too, get tax bonanza from the Government in a variety of ways (for instance, special package under composition scheme of Goods and Services Tax as well as income tax). They may not find a place in the billionaires’ club but definitely earn the multi-millionaire tag.

Then, there is the trader class, particularly entities dealing in farm commodities. They buy products from farmers at a throwaway price — the minimum support price (MSP) notified by the Government remains mostly on paper as its agencies don’t have the wherewithal to procure their produce — and sell to the consumer at a high price. Irrespective of whether there is surplus or deficit, Indian markets are so orchestrated that only traders emerge as the real beneficiaries at the expense of farmers at one end and consumers at the other.

There is yet another class of rich who are an offshoot of corruption in governance systems. This includes corrupt bureaucrats, politicians (besides dubious businessmen) who amass wealth disproportionate to their known sources of income by siphoning off funds from welfare schemes and diversion of funds borrowed from public sector banks to personal accounts or shell companies of which they are the ultimate beneficiaries.

How does the Government address income inequalities? Typically, this takes the form of giving relief to the poor by providing State assistance in cash or kind. For instance, under the PM-KISAN, the Government gives Rs 6,000 per annum to each of the 145 million farmers in the country in three installments of Rs 2,000 each. As for help in kind, it provides Mid-Day Meals to schoolchildren or free medical services to Economically Weaker Sections in hospitals.

There are umpteen instances of such assistance — both by the Centre and States — entailing a mountain of burden on the public exchequer. All of this goes only to help millions barely survive even as a good slice of this is siphoned off (the malice continues in substantial measure despite the Government’s efforts to prevent it, using the direct benefit transfer mechanism). However, it does nothing to augment their productive capacity and prepare them for getting jobs. Even where funds are given for empowering and increasing the income earning capacity (for instance, availability of credit at concessional rate of interest to farmers and others engaged in petty occupations, supply of agricultural inputs such as fertilisers at subsidised rate, free electricity to farmers and so on), much of the promised help either does not reach or is cornered mostly by better-off farmers. Even those who gain from these support measures are at the receiving end when it comes to interface with traders for selling their produce.

Quite clearly, despite mammoth sums spent on welfare of the poor or “empowering” them, income inequalities increase even during periods of rapid economic growth. Even when, growth decelerates (for instance, during the current year when it declined to an 11-year-low of five per cent), then also the inequalities persist as the poor lose much more than the loss experienced by the rich.

The solution doesn’t lie in more sops, concessional credit, fiscal incentives and so on. There is need for a fundamental change in the way our industrialists do business and politicians and bureaucrats conduct themselves. While, the former need to shed their overzealousness for profits, charge less from consumers, distribute more to workers and pay more taxes, the latter must ensure that every rupee is spent for the welfare and empowerment of the poor.

Even as the Government shuffles policy choices to attune them for creating more jobs and increase income (by promoting labour-intensive sectors such as textiles, apparels, food service, hospitality and so on), unless the stakeholders change their mindset towards the majority who are not so privileged, inequalities will continue to haunt and as pointed out in the GRR, even growth will remain vulnerable to the deep divide between the rich and the poor.

(The writer is a New Delhi-based policy analyst)