The house must be set in order, else this will have catastrophic consequences for power producers, banks, States and Modi's plans to supply electricity to every household

Even as there are incessant promises from the ruling establishment of electrifying all villages in the country and making power available to each and every household for maximum duration in a day, the most crucial wheel required for making this happen has got stuck. And the irony is that the political brass is only paying lip service to the urgent need for extricating it. The reference here is to the power distribution companies (discoms) — mostly owned and controlled by State Governments which procure electricity from the independent power producers (IPPs), Public Sector Undertakings (PSUs) like the National Thermal Power Corporation (NTPC), Damodar Valley Corporation (DVC) and so on, besides their own undertakings such as Rajasthan Rajya Vidyut Utpadan Nigam (RVUN) and sell to consumers. There are some discoms in the private sector as well but they, too, can’t ignore the diktats of the state.

Ever since the dawn of the present century, the discoms have been incurring losses primarily due to three factors. First, being their sole owner and controller, the ruling establishment runs discoms as an extension of the state machinery, ordering them to sell electricity to a certain category of consumers viz. poor households and farmers either at a fraction of the cost of purchase and distribution or even free. On the units sold to this class, the discoms incur heavy under-recovery. At the same time, they are told to sell to industries and businesses at a price much above the cost to enable them to offset under-recovery on sale to preferred customers. But, even after offset, losses remain.

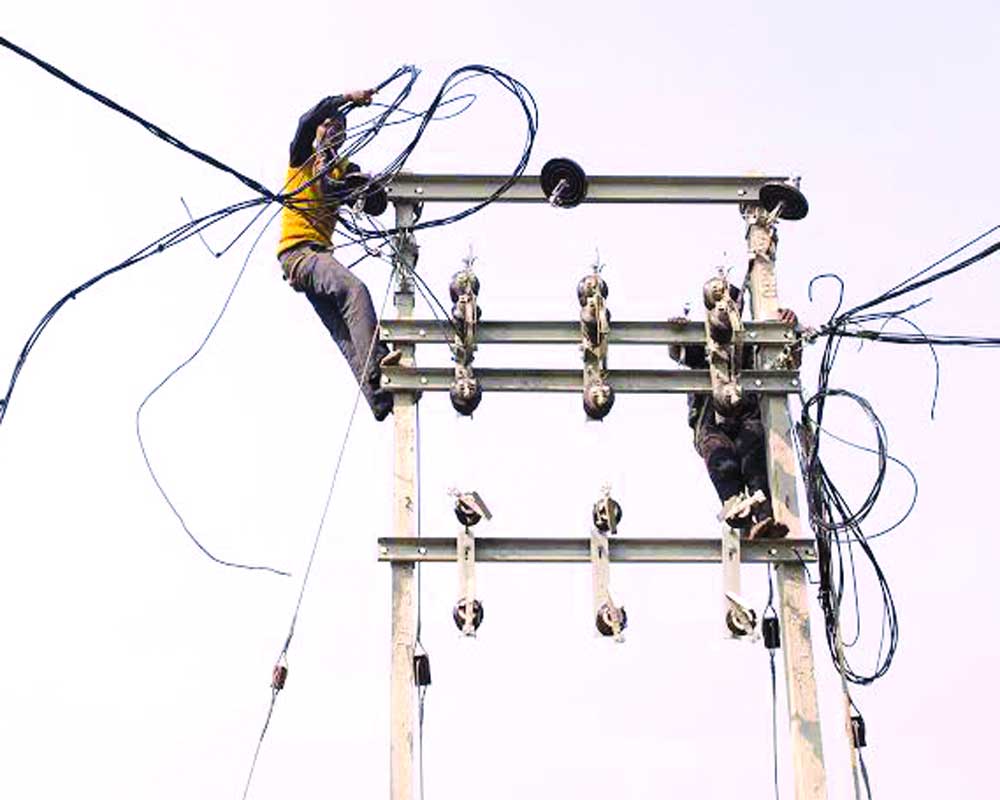

Second, in the course of transmission and distribution of electricity, there are so called “technical and commercial” (T&C) losses. Most of it is plain theft which is facilitated by faulty transformers, meters and other equipment. There being no revenue from stolen power, this further exacerbates the losses.

Third, under the power purchase agreements (PPAs) signed by discoms, States allow inflated tariff to generators taking recourse to “gold plating” (euphemism for claiming higher investment than actual), excessive overheads and over-invoicing of fuel bills and so on.

The above three factors make a deadly combination leading to shortfall in the realisation from sale, vis-à-vis the cost of supplying electricity which gets manifest in their loss. Funded by borrowings, this leads to accumulation of debt to unsustainable level. To ensure that they are able to sustain operations and the spillover effect on the rest of the economy is arrested/avoided, the Government had come out with three bail-out packages since 2000 — the latest being in 2015.

In 2015, under a financial restructuring package (FRP) orchestrated by the Union Government, over 75 per cent of the outstanding debt, about Rs 400,000 crore of discoms were taken over by State Governments whereas for the balance 25 per cent, they were allowed to issue bonds — backed by sovereign guarantee — to raise funds at concessional interest rate. The FRP was intended to enable discoms to wipe the slate clean, reduce losses and eventually eliminate them.

During 2016-17 and 2017-18, they did show significant reduction with losses declining from Rs 52,000 crore during 2015-16 to Rs 32,000 crore during 2016-17 and Rs 17,000 crore during 2017-18. During 2018-19, this trend was reversed with losses increasing to Rs 28,000 crore. The trend continues during the current year. A collateral damage has been by way of increase in pending payment to power generators. Thus, the amount due for more than 60 days increased from about Rs 23,000 crore as of March 2018 to Rs 71,000 crore as of November 2019. All dues including those pending for less than 60 days — as on this date — were even higher at about Rs 81,000 crore.

This has a debilitating effect on the ability of generators to service loans taken from banks and financial institutions (FIs). A good chunk of those loans have already become non-performing assets (NPAs). Moreover, given their precarious finances, discoms are forced to reduce off-take which affects capacity utilisation. It leads to an anomalous situation whereby despite ample capacity, electricity generation declines affecting supplies.

There is an urgent need to set the house of discoms in order, or else this will have catastrophic consequences for all stakeholders, viz. power producers, banks/FIs, finances of States and jeopardise Prime Minister Narendra Modi’s grandiose plans to supply electricity to every household. So, what is the Government doing to set things right?

From August 1, 2019, it made mandatory for discoms to open letters of credit (LOC) for getting supply from generators (gencos). Under the LOC arrangement, the bank guarantees that a buyer’s payment to a seller will be received on time and for the correct amount; in the event that the buyer is unable to pay, the bank will be required to cover the full or remaining amount which in turn, it will recover from the buyer using all available legal means.

Relying on the above, in September, 2019, the Union Power Minister, RK Singh even exuded confidence that this would prevent creation of fresh dues. But this has not happened as may be seen from arrears continuing to be on an upward trajectory from about Rs 49,000 crore in February, 2019 to over Rs 71,000 crore as of November 2019. Clearly, the mechanism has not worked even as generators are forced to maintain supplies despite not receiving payment.

Singh was also optimistic that by incorporating a provision for penalty (or surcharge) for delayed payment at commercial rate of interest of 18 per cent in the New Tariff Policy (NTP), it should be possible to eliminate all pending dues. This may work while dealing with private entities (in fact, in those cases, the problem may not even arise in the first place) but not when it comes to dealing with state entities. So, it is unlikely that the legacy dues would be cleared.

Under the NTP (this is yet to be approved by the Union Cabinet), the Government has also proposed capping of tariff hike to 15 per cent of the under-recovered power supply cost. Further, they won’t be eligible for grant or loan if they don’t make efforts to reduce losses. These, too, are unlikely to work in improving their financial position and ability to clear the arrears and make timely payments in future.

Let us not forget that at present, even after increasing tariff — mostly directed at industries and businesses (a big chunk of households and farmers are never touched) — discoms incur loss. If a hike is restricted to just 15 per cent then their loss would be even bigger. Far from any help in reducing, such a stipulation will only end up increasing loss as they lose the flexibility to hike tariff. Similarly, the pressure by way of denying grant or loan won’t be of much help.

The Government is also contemplating a Special Loans Plan (SLP) under which banks will be asked to give loans to discoms to enable them to clear their dues to gencos. This will have serious implications for the banks. Considering that discoms won’t be able to pay back (given their precarious finances and no effort being made to address the fundamental factors behind their losses), these loans will be NPAs from day one. For banks struggling to come out of the crisis they got into (courtesy, legacy NPAs), this will compound their woes.

True, payment by discoms to gencos (enabled by SLP) will enable the latter service loans they had taken from banks thereby preventing those loans from becoming NPAs. However, for banks, this is no consolation as one set of NPAs would have been substituted by another. Besides, the gencos will continue to remain vulnerable to payment default as long as the discoms remain financially unviable. The SLP may solve today’s problem but after some time, dues will pile up requiring Centre’s intervention yet again.

Let it be understood in no ambiguous terms that whether it is the FRP (granted thrice over earlier) or SLP under consideration now, these are merely “band aids.” These don’t offer sustainable solution even as the problem keeps on festering beneath.

A sustainable solution can emerge only by tackling the fundamental causes which contribute to losses of discoms. The Centre and States should put their heads together to do away with sops to farmers and households, eliminate theft and rein in inflated tariff under PPAs.

(The writer is a New Delhi-based policy analyst)