Sitharaman's Sunday Sell-Off

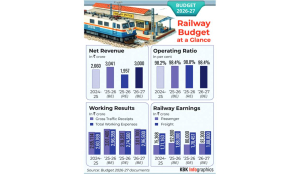

Finance Minister Nirmala Sitharaman’s ninth Budget was one about high-stakes hedging. While she pushed for tech investments in India with tax holidays and chip outlays, the markets reacted with a 1,100-point Sunday sell-off.The aggressive hike in Securities Transaction Tax (STT) to curb the F&O frenzy essentially spooked markets, along with missing incentives for foreign investments, leading to broad-based sell-off. Meanwhile, very little of consequence was said about agriculture and jobs.

Finance Minister Nirmala Sitharaman presented the Union Budget for the financial year 2026–27 in the Lok Sabha on Sunday, the second time it was tabled on a Sunday. “India must also remain deeply integrated with global markets, exporting more and getting stable long-term investments,” Sitharaman said.This budget comes at a time when global orders are changing, and India faces a massive 50% tariff burden from its biggest export market, the US.

The budget speech announced tax holidays for certain sectors and finance outlays for others, while it completely skipped sectors like jobs and agriculture. The stock market plummeted over 1,000 points during Sitharaman’s speech.Here are the biggest highlights from her speech:

Wooing Cloud Giants

Sitharaman announced that foreign companies which provide cloud services globally through data centres in India will get a cloud tax holiday till 2047. These companies, however, will have to go through an Indian reseller entity to serve Indian customers.

Himanshu Sinha, Head of Tax Practice at Trilegal, had told The Core earlier last week that a tax holiday for data centres could be on the cards. “Now, the point is, the larger policy question is that this may amount to a reversal of earlier policy pronouncements made by the government that they are largely in favour of not having tax holidays. And on this rationale, the government had brought down the corporate tax rate a few years ago to a very moderate rate of 22%, which is lower than the contemporary OECD rates that you see elsewhere in the world,” Sinha had said.

Breaking China Dependence

Sitharaman announced rare earth corridors in Odisha, Kerala, Andhra Pradesh and poll-bound Tamil Nadu, furthering its bid to reduce dependence on China.The government had already approved Rs 7,280 crore to manufacture Rare Earth Permanent Magnets (REPM) in India.Critical minerals and rare earths made headlines throughout the previous year as China imposed export restrictions. India holds the world's third-largest rare earth reserves, which make up for 8% of the global total. The reserves are mostly concentrated in the states where the corridors were announced.Sitharaman also proposed doing away with duties on capital goods required to manufacture critical minerals.

Semiconductor

The government continued its bid to make India into a semiconductor manufacturing hub, announcing India Semiconductor Mission 2.0. The scheme will have an outlay of Rs 40,000 crore.“We will launch ISM 2.0 to produce semiconductor equipment and materials, develop full-stack Indian IP, and strengthen supply chains," Sitharaman said.

This scheme, the finance minister said, was to build on India’s first semiconductor mission scheme.

Buyback Tax Reset

Sitharaman also announced changes in the taxation framework governing share buybacks. The reform, she said, aims to shift the burden of taxation to better protect minority shareholders while penalising potential tax arbitrage by company insiders. Under the new guidelines, share buybacks for all categories of shareholders will now be classified and taxed as Capital Gains.

“I propose to tax buyback for all types of shareholders as Capital Gains. However, to disincentivise misuse of tax arbitrage, promoters will pay an additional buyback tax. This willmake the effective tax 22% for corporate promoters. For non-corporate promoters, the effective tax will be 30%,” she said.

Carbon Tech Funding

As had been an expectation for many in the energy sector, carbon capturing found mention in Sitharaman’s budget. She announced an outlay of Rs 20,000 crore over the next five years. “Aligning with the roadmap launched in December 2025, CCUS (Carbon Capture Utilisation and Storage) technologies at scale will achieve higher readiness levels in end-use applications across five industrial sectors, including power, steel, cement, refineries and chemicals,” Sitharaman said.The government had launched an initiative for research and development into carbon capturing in December 2025. Carbon capture and storage is essential for India’s road to its Net Zero targets.

Buying Time For IT

Sitharaman announced the easing of safe harbour rules for India’s struggling IT sector. Now, the threshold for availing safe harbour for IT services is Rs 2000 crore, increased from Rs 300 crore. “Safe harbour for IT services shall be approved by an automated rule-driven process without any need for tax officer to examine and accept the application. Once applied by an IT Services company, the same safe harbour can be continued for a period of five years at a stretch at its choice,” Sitharaman announced.

She also said that IT-enabled services, knowledge process outsourcing services and contract R&D services relating to software development will now be clubbed under a single category of Information Technology Services with a common safe harbour margin of 15.5% applicable to all. Lack of global demand and AI have slowed down the IT sector, leading to massive job losses over the past few years. It is still one of the biggest contributors to India’s GDP.

Taxing The F&O Frenzy

Sitharaman announced that the Securities Transaction Tax (STT) on Futures and Options will be increased to 0.05% from the present 0.02%. “STT on options premium and exercise of options are both proposed to be raised to 0.15% from the present rate of 0.1% and 0.125% respectively,” Sitharaman announced. This announcement spooked the markets, with both the BSE Sensex and the NSE Nifty50 tumbling. This tax is applied to market transactions and will lead to higher costs for investors putting money into futures and options.

This article was originally published in The Core

India's biggest post-budget Finance & Innovation Forum over 3-days at WTC, Mumbai.

The Pioneer presents India Finance & Innovation Forum 2026 convenes policymakers, regulators, financial institutions, and industry leaders at a moment when India’s financial architecture is being actively reshaped. Over three days, the Forum will focus on fiscal and monetary priorities, capital markets, digital finance, and innovation-led growth—grounded in real-world challenges and institutional decision-making.

Designed for senior decision-makers, IFIF 2026 combines on-stage dialogue with curated networking, innovation labs, and collaborative working sessions. The focus is on understanding what is changing, what is working, and what comes next for India’s financial system.