Rupee tumbles, Trump bumbles, Russian oil stumbles, exporters grumble

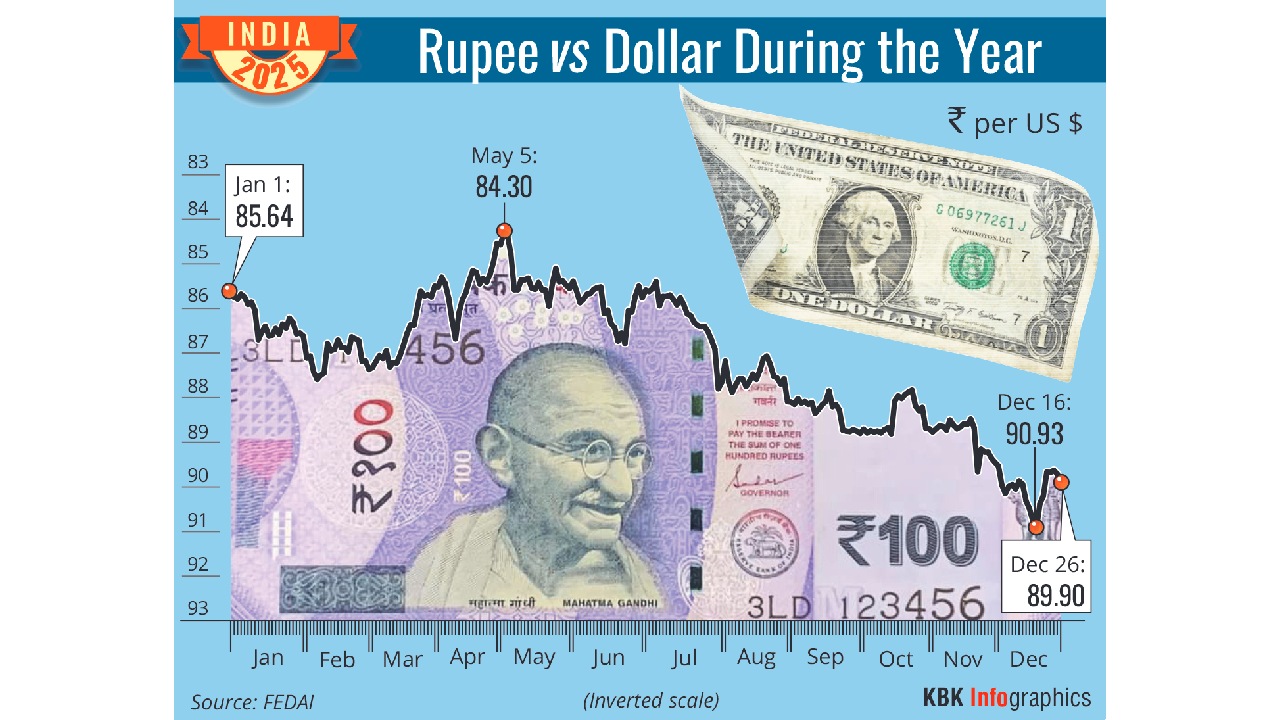

In the run up to the Lok Sabha elections in 2014, many experts, voters, and celebrities mocked the then paralysed and semi-comatose Congress-led regime by asking two economic, and speculative, yet serious, questions. The first was about the price of petrol crossing INR 100, and the second about the rupee depreciating to INR 100 against the dollar. Then, the rupee ruled at around INR 60, and petrol at around INR 70, depending on the city. In a few cities, petrol now sells for more than INR 100. The rupee, which has fallen for several years, breached INR 90, and there are speculations about it crossing INR 100.

In fact, the questions have reversed. It is now the Opposition, which is comparing 2014 with 2025, and criticising the current regime for having allowed petrol prices to go up by 40 per cent, and rupee to fall by 50 per cent in 11 years. If the rupee continues its slide, it will cross Rs 100 to a dollar in 18-24 months. Inevitably, by the time of the next national elections, the two Rs 100-related questions will re-emerge, albeit in a more serious and humorous fashion.

One of the villains, possibly wrongly, in this two-act energy-currency play is the US president, Donald Trump. After January 20, 2025, when Trump assumed the office, he adopted a Mad Hatter policy of ‘off with their heads.’ No nation and economy was spared either the anguish and nervousness, or threats of tariffs, trade barriers, and sanctions. Many nations succumbed, some survived, and a few had major face-offs with America. India fell in the last category; it initially defied, and then crumbled due to the rupee and trade factors despite the economy being resilient.

Exports remained strong but wobbly. While they grew to $825 billion in 2024-25, up six per cent from the previous year, the estimates for 2025-26 are $850 billion, or a growth of three per cent. Even if India manages a bilateral deal with the US within a couple of months, the global environment remains challenged in 2026-27. The slew of free trade agreements inked with the non-US nations and regions to find alternative markets may boomerang, and increase imports. The trade deficit may zoom, as it did in some of the months in 2025.

Along with forex outflows due to stock sales by foreign investors, and global investments by Indian MNCs, the exports slowdown and trade deficit impacted the rupee. The Reserve Bank of India intervened but not too aggressively, as policy-makers linked the decline of the currency with a booming economy. One of the economic advisors claimed that local currencies depreciate when economies do well, as was the case with Japan and China in the earlier decades. Others felt that the nation did not need to fear the free fall of the rupee.

Petrol prices, and those of other petroproducts, were indirectly impacted by Trump. The US president used the tariff pressures to arm twist India, and force the latter to buy less crude oil from Russia. After staving off Washington for months, New Delhi capitulated, especially after fresh western sanctions were imposed against two of the largest Russian oil producers and exporters. One of them had purchased the businesses of the former Indian refinery giant, Essar Group. Until December 2025, Indian refiners, especially state-owned ones, bought Russian crude for domestic consumption.

Russian crude was available at huge discounts to the global markets, and the difference was $10-15, which dwindled to $1, according to some estimates. But domestic petrol prices remained high because the benefits were gorged by the refiners, who pocketed the super profits, and gobbled the extra refining margins. Local taxes on petroproducts, a major revenue source for the Government, were high. Thus, the consumers suffered, as they paid INR 100+ per litre, and the state-owned and private players enjoyed the ‘slick’ party.

Another equally shiny commodity was gold, which glowed but the sheen was lost out on the economy. As the bullion prices soared, as they have since the pandemic, Indians purchased more of the yellow metal, and invested more in gold-based exchange-traded funds. The same was true elsewhere in the world. But this meant that gold imports went up, and fuelled the trade deficit. People were busy comparing notes on how they made money on gold purchased earlier. One of them bought some two months ago, and made a paper profit of INR 20,000 per 10 grams, or a margin of 16-17 per cent.

However, IT and software lost its lustre due to problems with the US, as well as global trends. America made it more difficult for Indian techies to migrate due to $1,00,000 fee on new H-1B visas, restrictions on them, and changes in the current lottery system. Many Indians, who were stuck in their native country, found it difficult to go back as new norms kicked in. American policy-makers forced the visa applicants to make their social media platforms public to assess anti-American and un-American activities. Indian students going to the US for higher studies were the worst sufferers.

The external had an internal impact, which may influence future politics. Farmers became apprehensive about the trade deals, especially the forthcoming one with the US, which may open the doors for imports of farm products. In several states, entry of foreign dairy and agriculture produce may change the electoral equations. Indian producers are cagey about cheap foreign goods being offloaded on Indian shores. They may partly close the moneybags that finance the elections. Consumers will benefit but workers may lose jobs. There are just too many ifs and buts, ohs and aahs.