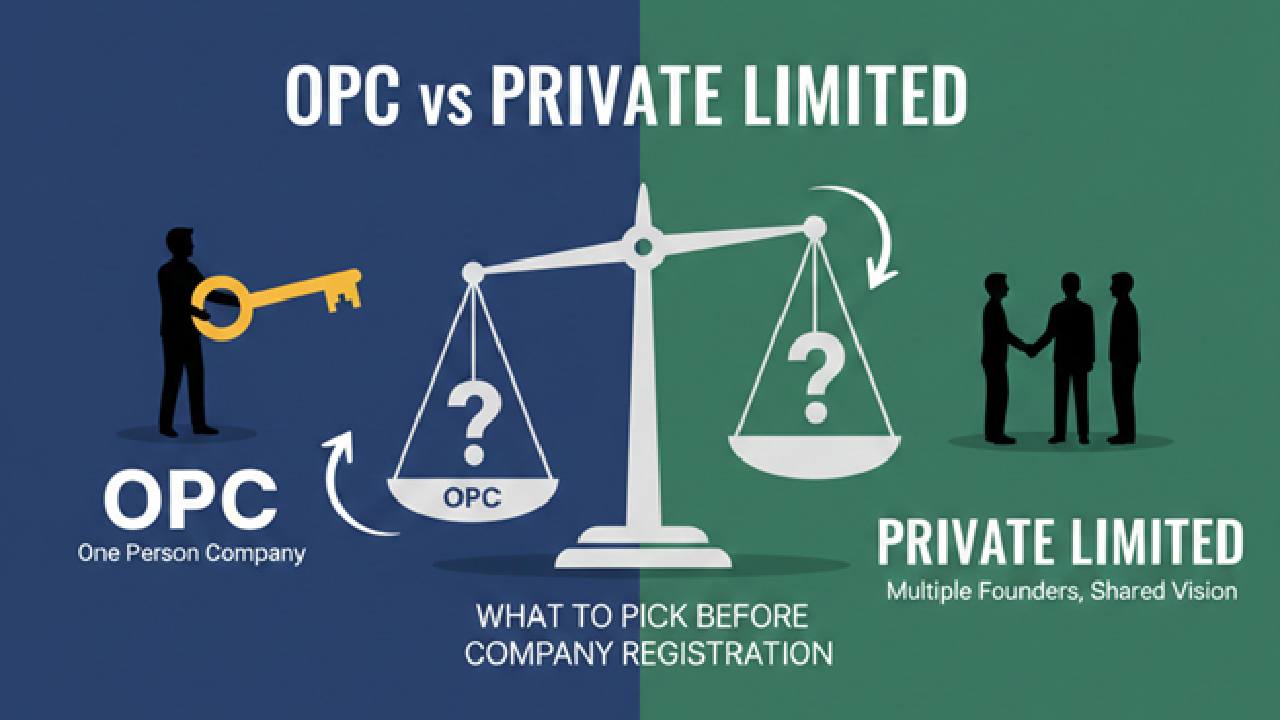

OPC vs Private Limited: Which Registration Fits Your Business Roadmap?

When starting a business in India, the first real decision often goes beyond the idea itself. It’s about choosing the proper legal structure. For many modern founders, this choice usually comes down to two options: a One Person Company (OPC) or a Private Limited Company.

While both offer limited liability and a professional corporate image, they cater to very different business goals. In 2026, where speed and scalability are the name of the game, picking the wrong one early on can lead to expensive legal shifts later. Here is everything you need to know to make an informed choice for your Pvt Ltd company registration or OPC setup.

What Is a One Person Company (OPC)?

A One Person Company is designed for solo founders who want the benefits of a company without bringing in partners or shareholders. As the name suggests, it allows one individual to own and manage the entire company. An OPC has a separate legal identity, meaning it exists independently of its owner. The law also requires the appointment of a nominee who takes over if the owner becomes unable to manage the business.

Key Features of an OPC

- Only one shareholder & one nominee required

- Limited liability protection for the owner

- Separate legal entity

- Suitable for small or early-stage businesses

- Restrictions on raising equity funding

OPCs are often chosen by freelancers, consultants, and individual entrepreneurs testing a business idea.

What Is a Private Limited Company?

A private limited company is the most common business structure for startups and growing businesses in India. It allows multiple shareholders and is structured for scalability and investment. This model is typically preferred by founders planning long-term growth, external funding, or partnerships.

Key Features of a Private Limited Company

- Minimum two shareholders and two directors (Can be the same individuals)

- Limited liability for shareholders

- Separate legal identity

- Ability to raise equity from investors

- Higher credibility with banks, vendors, and clients

Because of its flexibility and growth potential, pvt ltd company registration is often the default choice for startups aiming to scale.

OPC vs Private Limited: Key Differences

Here’s a simple comparison to understand how the two structures differ:

|

Basis |

One Person Company (OPC) |

Private Limited Company |

|

Ownership |

Single shareholder |

Minimum two shareholders |

|

Directors |

Minimum one director |

Minimum two directors |

|

Legal Status |

Separate legal entity |

Separate legal entity |

|

Liability |

Limited to the capital invested |

Limited to the capital invested |

|

Fundraising |

Cannot raise equity funding |

Can raise equity from investors |

|

Scalability |

Limited growth potential |

Designed for long-term growth |

|

Compliance |

Lower compliance requirements |

Higher compliance obligations |

|

Decision-Making |

Faster, single-owner decisions |

Shared decisions by the board |

|

Conversion Rules |

Mandatory conversion after crossing thresholds |

No mandatory conversion |

|

Business Credibility |

Suitable for small or solo ventures not looking for funds |

Preferred by investors and banks |

Compliance and Legal Requirements

Both OPCs and private limited companies must follow MCA regulations, but the level of compliance differs.

|

Feature |

One Person Company (OPC) |

Private Limited Company |

|---|---|---|

|

MCA Filings |

Annual filings of financial statements and returns are mandatory. |

Annual filings of financial statements and returns are mandatory. |

|

Statutory Audit |

Mandatory audit by a Chartered Accountant every year. |

Mandatory audit by a Chartered Accountant every year. |

|

Board Meetings |

Only one board meeting per half-year is required (if there are 2 directors). If only 1 director, no meeting is needed. |

Mandatory to hold at least four board meetings a year (one every quarter). |

|

Shareholder Meetings |

Not required to hold an Annual General Meeting (AGM). |

Mandatory to hold an Annual General Meeting (AGM) every year. |

|

Conversion Rules |

Mandatory conversion based on turnover thresholds applicable |

Not applicable (usually stays Private Limited or scales to Public Limited). |

|

Regulatory Disclosures |

Simplified disclosures for small entities. |

Extensive ongoing disclosures regarding loans, investments, and director interests. |

While compliance is higher for private limited companies, it also brings better transparency and trust.

Which One Should You Choose?

Choose an OPC if:

- You are a solo founder

- Your business is small or service-based

- You want limited liability with minimal compliance

- You are not planning to raise external funding soon

Choose a Private Limited Company if:

- You plan to grow and scale your business

- You want to raise funds from investors

- You have co-founders or plan to add shareholders

- You want long-term structural flexibility

The proper structure depends on your business goals. In many cases, founders start with an OPC and later convert it into a private limited company as the business grows.

Conclusion

There is no universally “better” option between an OPC and a private limited company. Each structure is built for a different stage of business growth. Understanding the limitations and advantages of both helps you avoid restructuring costs later.

If scalability, funding, and long-term expansion are priorities, a pvt ltd company registration offers more flexibility. If simplicity and single ownership matter more, an OPC can be a practical starting point. Making the correct choice early sets a strong foundation for your business journey.