No cheers in Dhaka over US deal

Although the bilateral trade deal between Bangladesh and America reverberated in controversial terms in India, it received a few bouquets, but more brickbats in Bangladesh. In the neighbouring nation, there were concerns due to the timing, secrecy, and the scale of concessions among industry groups, policy analysts, and opposition politicians. Indian industry was worried about the zero-duty that Bangladesh’s textile and apparel exports would enjoy if they were made from American cotton, and petrochemicals-based intermediates. Bangladesh was perturbed by the inclusion of conditions related to national security and geopolitics, tariff concessions for American imports, and questions about the protection of the nation’s interests.

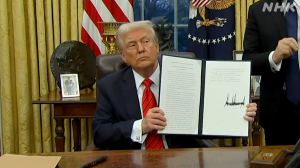

While New Delhi grappled with views that Bangladesh got more benefits than India, Commerce Minister Piyush Goyal allayed such fears, and declared the India-US final will have a similar zero-duty export clause. In Dhaka, the fear of unbridled and cheap American imports led to angry reactions. The former interim government, which was led by Nobel laureate Muhammad Yunus, was under flak. The US-Bangladesh pact, which was concluded days before its national election, was thus negotiated by a temporary regime. Critics explained that it reduces US tariff by one per cent on exports, and obliges Bangladesh to accept commercial, regulatory, and strategic commitments.

“Externally driven, rigid conditionalities risk narrowing policy space, and creating uncertainty, especially for a developing economy navigating political transitions. Reforms should strengthen sovereignty, not dilute it,” wrote Muhammed Aziz Khan, chairman, Summit Group, in a column in a Bangladesh newspaper. He resides in Singapore, and heads a business empire with interests in Bangladesh’s power, ports, fibre optics, and real estate. He pointed out that the bilateral deal was silent on crucial issues such as upstream exploration, technology transfer, or risk sharing, and has a “limited clarity on taxation.”

In an interview with Bangladesh’s The Daily Star newspaper, Selim Raihan, a professor of economics at Dhaka University and executive director, South Asian Network on Economic Modeling, terms the deal as being “unequal, rushed, and risky.” He observes, “The agreement… signed by the interim government at the end of its tenure, offers only a marginal reduction in US tariffs but binds Bangladesh to a broad framework covering defence, energy, trade, labour and digital governance.” Raihan describes the bilateral deal as one that is “potentially damaging” to Bangladesh’s strategic independence.

Several opinion pieces in local media term the tariff change for the exporters as modest, and misleading. The US tariff reduces from 20 per cent to 19 per cent, yet when combined with the existing average US general tariff of 15.5 per cent due to the most-favoured nation, the effective tariff on many Bangladeshi exports will be 34.5 per cent. Observers note that the small concession contrasts sharply with the breadth of market access and regulatory concessions Bangladesh grants to the US exporters and investors. A concern is the scope of tariff liberalisation.

The agreement lists 6,710 US products for which the nation will provide concessions, and the export concessions are on 1,638 products. Of the US items, around 4,500 will come in duty-free, and span segments such as livestock, meat, fish, chemicals, textiles, machinery, and other industrial goods. Additional categories face phased reductions over four to 10 years. Local producers warn that such sweeping duty removals can expose the domestic agriculture and industry to sudden competition, and reduce government revenues from import duties.

Beyond tariffs, the pact requires Bangladesh to remove non-tariff barriers that previously limited or conditioned the US exports. The text obliges Bangladesh to accept US regulatory approvals in areas such as medical devices and pharmaceuticals, recognise US vehicle safety and emissions standards, and lift import bans or licensing requirements on remanufactured US products. In agriculture and biotechnology, the pact asks Bangladesh to accept US sanitary and phytosanitary measures as alternatives to domestic standards. This will allow biotech products cleared in the US to enter Bangladesh without testing or mandatory labelling, and reduce testing requirements for certain food imports.

Critics argue that such provisions weaken Bangladesh’s ability to enforce biosecurity, food safety, and consumer-protection measures. The deal contains mandatory procurement commitments that go beyond the standard trade liberalisation. Bangladesh will purchase 14 Boeings, import $15 billion worth of US energy products (principally liquefied natural gas) over 15 years, and buy $3.5 billion of US agricultural goods, including 7,00,000 tonnes of wheat every year for the next five years, apart from a large quantity of one-time soybean purchase. The deal encourages increased military procurement from the US.

Analysts warn that these obligations can raise import costs, strain public finances, and reduce the ability to source cheaper or faster supplies from alternative markets. On investments and market access, the pact grants US firms a parity with domestic firms in strategic sectors such as power, telecom, transport, and resource extraction. It removes caps on US capital in oil, gas, insurance, and telecom, and exempts US insurers from a reinsurance requirement. Given the financial and technological advantages of MNCs, critics argue that these clauses risk crowding out local firms, and eroding the sovereign control over infrastructure and natural resources.

According to some experts, the deal imposes constraints on subsidies and industrial policy. Bangladesh must limit non-commercial assistance to the state enterprises, disclose subsidies to the WTO within six months, and reform the subsidy regimes in line with WTO. For a developing economy that uses targeted subsidies to support nascent industries, and generate employment, the rules can curtail policy to promote industry and protect jobs. Perhaps most consequential issues relate to national security and geopolitics. The text ties Bangladesh to US security measures, and requires complementary restrictive actions if the US adopts border or trade measures for security reasons.

The pact restricts Bangladesh’s ability to enter digital-trade deals or technical standards that the US deems harmful, and allows the US to cancel the bilateral deal, and reimpose punitive tariffs if Bangladesh signs agreements with nations that the US deems non-market actors. Observers say these can limit Bangladesh’s diplomatic autonomy, and force alignment with US foreign-policy priorities. Officials argue that the deal protects market access, and will stabilise US exports. But many are unsure if the modest tariff relief, and extensive strategic commitments do not represent an unequal bargain.

In another strongly-worded opinion piece, The Daily Star newspaper concludes, “According to Article 6.6 of the (bilateral) agreement, it is supposed to come into effect 60 days after the completion of all legal processes. It is hoped that the newly-elected government will take the initiative to cancel this agreement through discussion in the national parliament, as it runs contrary to national interests.”

(The author has more than three decades of experience across print, TV, and digital media); views are personal