Most Common and Unusual Car Insurance Claims in India

Not Just Accidents: Most Common and Unusual Claims Filed Under Car Insurance

You rarely think about car insurance on a normal day. It usually comes to attention when something goes wrong. A minor dent in traffic, a stalled car after heavy rain, or damage while the car is parked can quickly turn into a claim. While many of these situations are familiar, some are unexpected and remind you how unpredictable driving can be.

From everyday accidents to unusual incidents, car insurance claims in India cover a wide range of situations. Knowing what mostly leads to claims as well as unusual situations can help you use your policy more wisely.

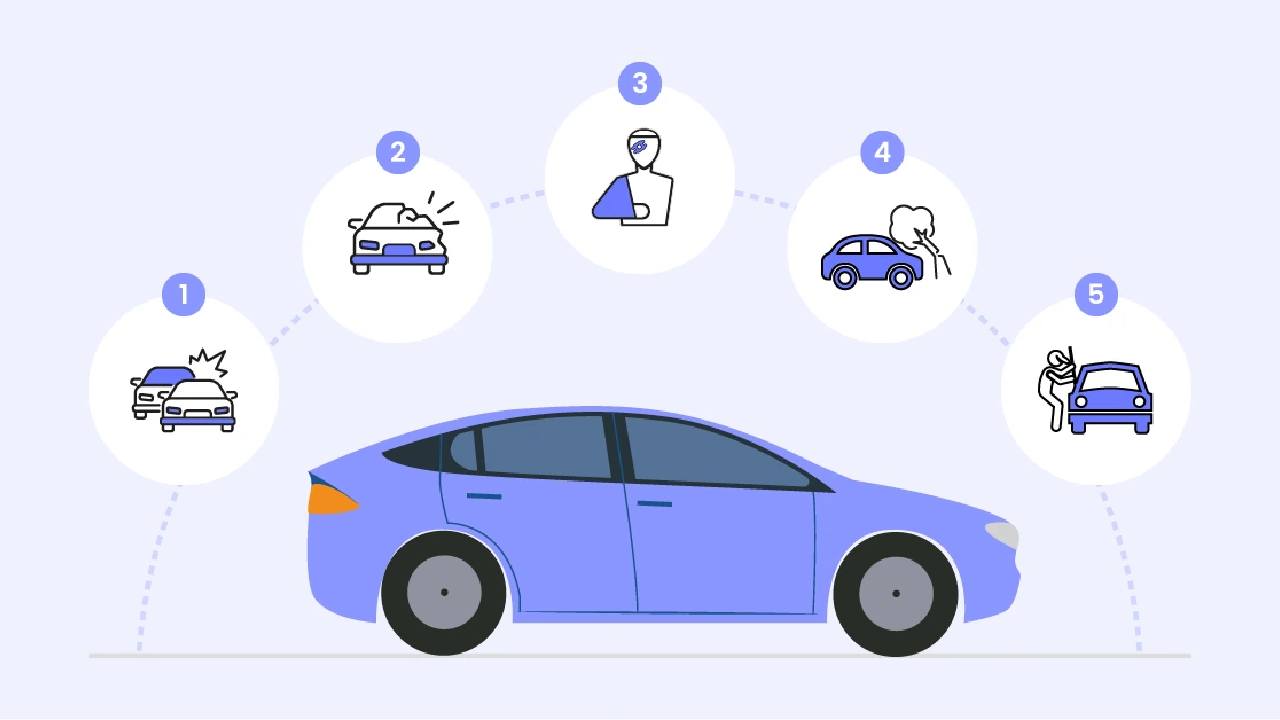

Claims You are Most Likely to See

Most car insurance claims come from regular driving conditions, and many car owners experience these at some point. They include:

●Accidents and Collisions

Slow movement of traffic, sudden braking or over-speeding, and tight parking can lead to scratches, dents, or major damage to your car. Even a small, low-speed collision can leave you with repair bills that make raising a claim necessary.

●Damage Caused by Poor Roads

Potholes, uneven roads, and uncovered drains can take a toll on tyres, suspension, and the underbody. During the monsoon, waterlogged roads raise the risk of engine damage, which is why claims increase sharply at this time.

●Theft and Break-Ins

Car theft and break-ins are still common, especially in cities. Sometimes the vehicle is stolen, and in other cases, parts like mirrors, wheels, batteries, or infotainment systems go missing while the car is parked.

●Damage Due To Natural Events

Heavy rain, floods, fallen trees, cyclones, and landslides damage cars. Flood-related damage leads to a high number of claims during the monsoon. However, engine damage caused by water ingress is usually covered only if the policy includes an engine protection add-on.

Claims That Take Drivers by Surprise

Alongside routine claims, there are some that stand out because they are unexpected. These include:

●Damage Caused by Animals

In some areas, vehicles can be damaged due to animal movement on or near roads. Claims have been reported involving animals such as cattle, monkeys, or elephants. There are also instances of collisions with wild animals on highways, particularly in stretches close to forested areas.

●Objects Falling on Parked Cars

Some claims involve falling coconuts, tree branches, construction material, or signboards on four-wheelers. These incidents often happen when cars are parked under trees or close to construction sites.

●Fire and Electrical Issues

Although not very common, fires caused by electrical faults, overheating, or poorly fitted aftermarket accessories do occur. These claims often involve significant damage and high repair costs.

●Vandalism and Civil Disturbances

Vehicles may be damaged during public disturbances or acts of vandalism, which can lead to insurance claims. Common issues reported in such cases include broken windshields, dented body panels, and damage to the car’s interior.

Keep in mind that these claims are typically covered only if you have comprehensive car insurance along with the required add-ons, like engine damage protection.

What These Claims Tell You About Car Insurance

Common claims show the risks you deal with every day on the road, while unusual claims highlight that some situations are beyond your control. Together, they explain why car insurance is more than a legal formality. A comprehensive policy helps you manage both everyday repairs and unexpected damage without added financial pressure.

Before buying a policy, it is important to check what it covers and what it won’t. You can also take the necessary add-ons to enhance your car’s protection.

Also, every claim you make can affect your No Claim Bonus, or NCB in car insurance. NCB is the discount you earn for not making any claims during a policy year, and it reduces your premium at renewal.

Conclusion

Car insurance claims in India range from day-to-day accidents to rare and unexpected situations. Knowing what usually leads to a claim helps you make better decisions when something goes wrong. It also helps to understand how a claim can affect benefits such as the NCB in car insurance, so you can decide whether filing a claim or paying for minor repairs yourself is the better option.