Markets soar on trade deal cheer

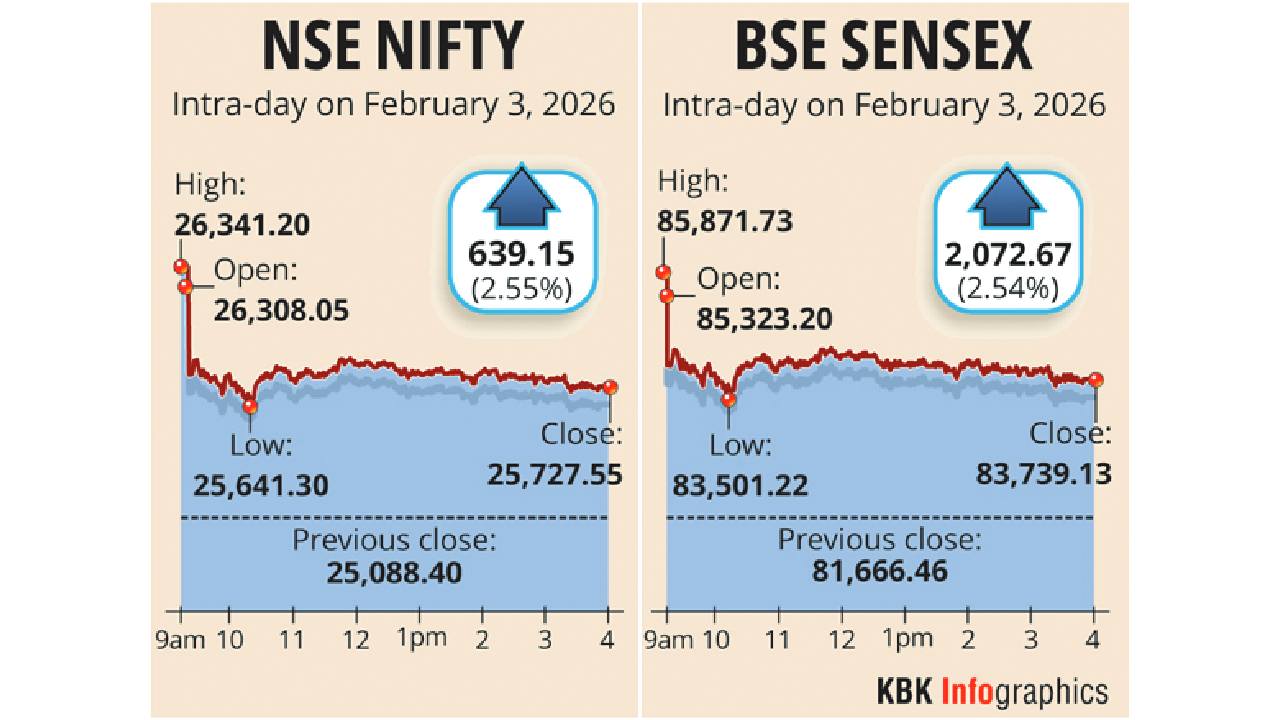

Domestic equity markets closed higher on Tuesday, with the Nifty rising 2.57 per cent to 25,732.45 and the BSE Sensex gaining 2,072.67 points to 83,739.13, after US President Donald Trump announced easing tariffs on India to 18 percent. The markets heaved a sigh of relief, as the overhang was out of the way.

India and the US have agreed to a trade deal under which Washington will bring down the reciprocal tariff on Indian goods to 18 per cent from the current 25 per cent, US President Donald Trump said on Monday after a phone conversation with Prime Minister Narendra Modi.

"Indian equity markets staged a sharp rally today, recording one of the strongest single-day gains in recent times after the announcement of a landmark India-US trade deal that significantly reduced reciprocal tariffs on Indian exports," Ponmudi R, CEO of Enrich Money, an online trading and wealth tech firm, said.

Addressing a press conference, Union Commerce Minister Piyush Goyal said India-US trade deal will open huge opportunities for the poor, fishermen, farmers and youth of the country. This trade deal with the US is a good omen for India's bright future, the commerce minister added.

"Indian equities experienced a significant rally today, driven by the long-anticipated India-US trade deal and a strengthening rupee, which boosted expectations of renewed FII inflows. The reduction of US tariffs on Indian goods from 50 per cent to 18 per cent enhances India's competitive position among emerging markets and bolsters the outlook for export-oriented sectors with high US exposure, such as textiles, aquaculture, gems and pharmaceuticals, which were supported in the 2026 Union Budget," said Vinod Nair, Head of Research, Geojit Investments Limited.

Market breadth turned decisively positive, led by export-oriented and commodity-linked sectors such as textiles, chemicals, and auto ancillaries, while financials, realty, pharma, and IT stocks also participated in the upmove, he said. Mid and smallcap stocks joined the rally on strong risk-on sentiment and short-covering activity, Ponmudi added.

"There is also a sigh of relief after the rupee recouped over 100 paise in a day, which may encourage renewed FII interest in local equities after witnessing continuous outflows over the past few months," said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.