Budget sinks Dalal Street

Stock market dipped on Sunday after the budget. Benchmark stock indices Sensex and Nifty dived sharply by nearly 2 per cent after Finance Minister Nirmala Sitharaman proposed a hike in the Securities Transaction Tax (STT) on derivatives.

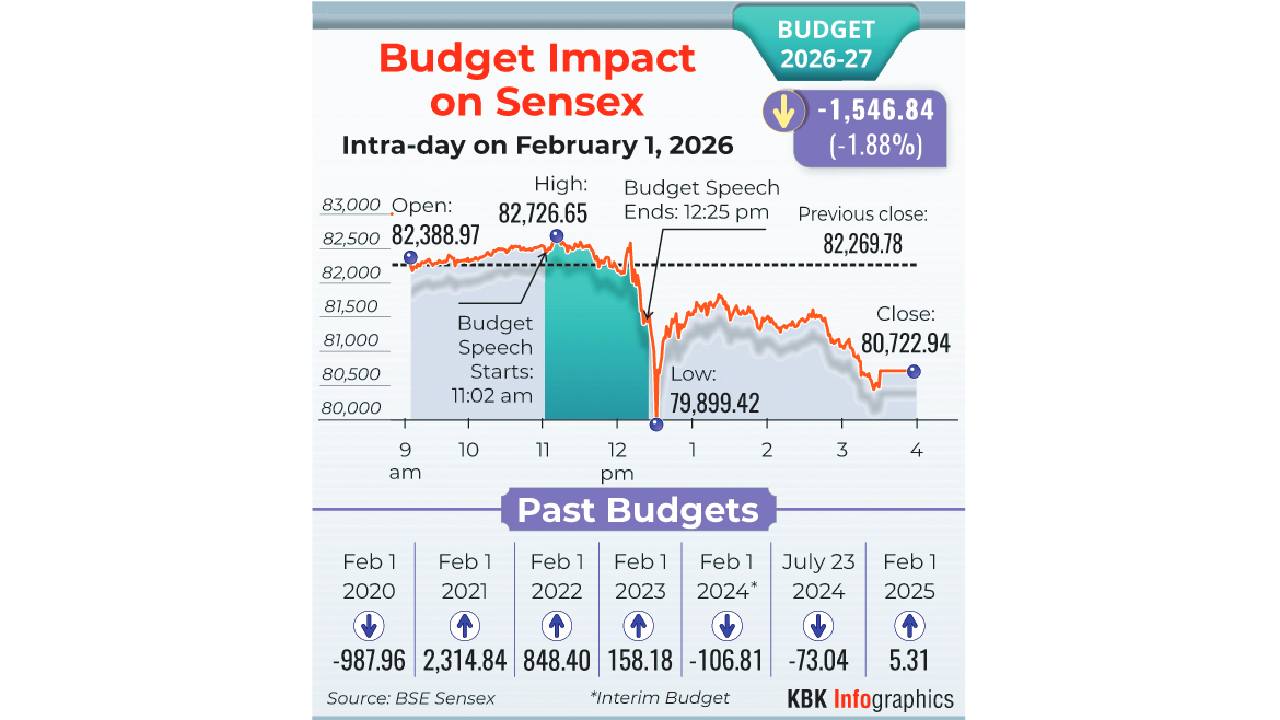

Reversing the early gains, the Sensex settled at 80,722.94, down 1,546.84 points or 1.88 per cent while the 50-share NSE Nifty tanked 495.20 points or 1.96 per cent to settle at 24,825.45. Stock exchanges held a special Budget Day trading session on Sunday in view of the budget presentation by Sitharaman for the next financial year.“Market unease is centred on the increase in STT on F&O, particularly the sharper hike on futures. Pranav Haridasan, MD and CEO, Axis Securities, said. “This comes on the back of higher capital gains taxes last year, raising overall transaction costs for market participants. These concerns are being voiced by foreign investors and domestic traders, and are reflected in the immediate market reaction,” he added.

Among indices, BSE PSU Bank dived the most by 5.60 per cent, metal tanked 3.85 per cent, commodities (3.35 per cent), energy (3.14 per cent), capital goods (3.02 per cent), utilities (2.98 per cent), industrials (2.66 per cent) and power (2.52 per cent). IT and BSE Focused IT were the winners.

A total of 2,375 stocks declined while 1,759 advanced and 175 remained unchanged on the BSE.Foreign institutional investors bought equities worth INR 2,251.37 crore on Friday, according to exchange data.Vinod Nair, Head of Research, Geojt Investments Limited, said, The budget supports sectors affected by global trade tariffs and focuses on emerging areas of development, including data centers, GCC, semiconductors, biopharma, rare earth elements, and manufacturing. Additionally, it extends support to traditional sectors like textiles, aquaculture, and MSMEs, which have been impacted by global protectionist trade policies, he said. “Despite these measures, the market’s reaction has been negative, primarily due to low expectations, limited outlays and the negative bias created by the increased Securities Transaction Tax (STT) for futures, triggering a knee-jerk response,” Nair noted.Asian and European markets are closed on Sunday due to holidays. US markets ended lower on Friday.