Blasé Capital CRUDE SHOCK

Nearly 30 minutes before the Bombay Stock Exchange (BSE) ended its trading session on Tuesday, the Sensex was down by nearly 450 points, or 0.5 per cent. The largest dragger of the index was Reliance Industries, which was down by INR 70, or more than four per cent. According to a media report, investors lost, more or less, INR 1,00,000 crore in a single day, or within a few hours, in a single stock. It was the worst single-session intra-day fall in the share price of Reliance Industries since June 2024. The stock “slipped below its 50-day moving average, even as it eroded the wealth and hopes of millions of people. Yet, among the 34 analyst reports, half of them recommended “strong buy,” and another 14 a “buy.” Only two wanted the investors to sell, and no one dared to suggest a “strong sell.”

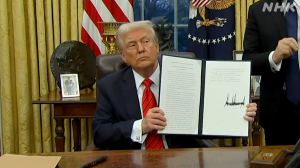

The immediate trigger for the fall was a report by a foreign news agency, which was categorically denied by Reliance Industries. The initial media report, which relied on data by the renowned Kpler, stated that three vessels full of Russian crude oil were headed towards the company’s Jamnagar refinery. It suggested that despite the western sanctions, and the US President Donald Trump’s railings over India’s imports from Russia, the largest private player in the country was going ahead with the purchases. While it indicated a national defiance, i.e., India was unwilling to bow before the American dictates, it hinted at Reliance Industries strategy to pursue the cheapest oil sources despite the geopolitical turmoil. A few days earlier, other reports stated that the state-owned Indian refiners continued to buy Russia crude in December 2025.

Reliance Industries issued a categorical denial. “A news report… claiming ‘three vessels laden with Russian Oil are heading for Reliance Industries Limited’s Jamnagar refinery’ is blatantly untrue. Reliance Industries’ Jamnagar refinery has not received any cargo of Russian oil… in the past three weeks approximately, and is not expecting any Russian crude oil deliveries in January (2026). We are deeply pained that those claiming to be at the forefront of fair journalism chose to ignore the denial by RIL of buying any Russian oil… and published a wrong report tarnishing our image,” the firm stated in a statement. Another news agency stated that with Reliance halting its Russian imports, India’s oil purchases from Russia will decline further in January 2026. In December 2025, the oil flows fell to a three-year-low of just over a million barrels per day, or down by 40 per cent from the peaks in June 2025.

Obviously, the company’s strong denial, and an admission that it will not buy Russian oil in January 2026 had an impact on investor sentiments. While Reliance wanted to dent geopolitical or political ramifications due to the initial news, the impact was felt on its stock. It was evident to the investors that the move to avoid Russian oil may have an impact on the balance sheet, and future profitability. Reliance, as was the case with the other private and state-owned refiners, was a huge beneficiary of cheap and discounted Russian oil, which boosted its refining margins in the years. With Russian oil out of the equation, Reliance will need to buy from the other more-expensive sources. This will dent the refining margins, which had boosted the overall corporate earnings in the recent past. Hence, the knee-jerk reactions, and bulk sales of the stock were expected.

In the past few months, however, analysts have calculated that the Russian crude oil was no longer lucrative for the Indian importers. First, the difference between the Russian prices, and global ones, had diluted from $10-15 a barrel to around $1-2. Given that the Russian oil comes via illegal and semi-legal channels, the associated costs are higher, either in terms of higher insurance, freight, and possible payments along the shipping routes. Although Russia manages and runs a well-oiled ‘shadow fleet,’ which includes old vessels run by criminals, smugglers, and syndicates, to help the importer-nations, the costs have increased due to greater western scrutiny. The modus operandi of the Russians, both for movements of oil, and transfers of payments, were tracked by the western media, and nations. Thus, it was more difficult to ship the Russian crude safely. The risks were too high, and there were geopolitical risk premiums to be paid.

Thus, weaning away from Russia, diversifying the import basket, and seeking fresh sources had become critical for the Indian refiners. Hence, the statement by Reliance Industries that it does not seek to import Russian oil in January 2026 is an intelligent strategy. India now buys more oil from America, as well as other sources. After the US action in Venezuela, the latter may become a crucial source, as it was several years ago before the western and American sanctions. But costs, or changing cost structures will be crucial. The Venezuelan oil, which too was available at huge discounts, may vanish once the American oil giants take over the industry. Global oil prices may perk up if the demand exceeds supplies. Most analysts accept the opposite view that oil prices may be lower, or move in a narrow band.