Blasé Capital BUDGET COMMENTS

In the technology sector, the launch of ISM 2.0 for electronics component manufacturing, will significantly strengthen domestic production capabilities, reduce import dependence, and accelerate innovation across the electronics and semiconductor value chain.

Arpit Mehrotra

MD, Colliers India

The push to develop rare earth corridors marks a strategic move to secure a critical mineral supply chain, and reduce reliance on China. The focus on integrated exploration, mining, refining, and downstream manufacturing enhances domestic value addition, and supports India’s high-tech manufacturing ambitions.

Divyam Mour

Analyst, SAMCO Securities

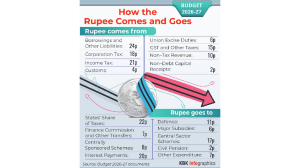

This budget has proposed a capital expenditure of `12.1 lakh crore, which is more than the net market borrowing of `11.7 lakh crore. I pray that a path is laid where one day capital expenditure will be more than the total borrowing including small savings.

Nilesh Shah

MD, Kotak Mahindra AMC

The high-level committee on banking, and the proposed restructuring of PFC and REC reflect a clear intent to future-proof India’s financial system. Strengthening public sector NBFCs through better scale, governance, and technology adoption is critical to ensuring that long-term capital reaches infrastructure and priority sectors efficiently.

Varun Gupta

CEO, Groww Mutual Fund

Allowing individuals resident outside India to invest domestically appears to be a positive reform. It may prove to be a step toward widening capital market access, improve liquidity, and deepen participation. Until operational details emerge, investors need to view this as a directional signal rather than a near-term catalyst.

Himanshu Srivastava

Principal, Morningstar Investment

The Budget champions the cause of MSMEs, manufacturing, and foreign funding. MSMEs are supported by a host of proposals like strengthening TReDS as a platform for purchase, invoice discounting, and boosting receivables.

Vivek Jalan

Partner, Tax Connect Advisory

Although fiscal prudence is demonstrated with 4.4 per cent fiscal deficit achieved for FY26 and 4.3 per cent projection for FY27, the larger than expected gross borrowing plan of Rs 17.2 lakh crore may have the market worried despite the net borrowing number of Rs 11.7 lakh crore being in line. All eyes are now on RBI policy later in the week to address bond market concerns.

Vishal Goenka

Co-Founder of IndiaBonds.com

The budget scores on continued front loading of Government capex at a time when policy transmission has been lagging. The announcement on Market Making Framework for corporate bonds, and introduction of Total Return Swaps’ reaffirms the Government’s commitment towards deepening corporate bond markets.

Basant Bafna

Head (Fixed Income), Mirae Asset Investment

Incentives for large municipal bond issuances will support urban infrastructure financing, while the proposed market-making framework for corporate bonds should improve liquidity and price discovery. The securitisation of TReDS receivables, and the SME Growth Fund together strengthen credit access for MSMEs, and reinforce the shift toward market-based financing.

Manu Sehgal

CEO, Brickwork Ratings