Big Oil is on the global boil again

For years, ‘Big Oil,’ or global oil MNCs, returned the huge amounts of cash that they spewed out to the shareholders. Instead of spending big bucks on new fossil fuel explorations, they turned their attention to downstream projects, and renewables. Now, the clock is turning back. Thanks to several trends, oil supermajors have begun to spend more on traditional exploration, and growth opportunities. National policies, energy security, geopolitics, industry trends, and experts’ predictions are responsible for this strategic shift across the globe. Indeed, carbon-neutral plays have begun to take a back seat in boardrooms.

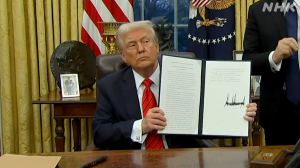

Let us start with national policies, and energy security. From America to Europe, China to Latin America, nations want to pay more attention to fossil fuel production. In the US, President Donald Trump backs the local oil majors, and his policies encourage new explorations, and renewed drilling in closed reserves. In Venezuela, he hopes to kickstart production to higher levels. The same is true in European nations. Despite the ongoing efforts in renewables, energy security encompasses the need to hike, rather than reduce, fossil fuel production.

Geopolitics has forced some of the nations to give up optimistic targets for renewable energy, and stick to crude oil and gas, even coal, as an immediate energy source. The Russia-Ukraine war, and lower fossil fuel imports from Russia prompted several European nations to restart shut operations in coal, and oil drilling. To acquire markets vacated by Russia, which was forced to do so due to western sanctions, and higher crude prices, the US firms, aided by policies, hiked production. For example, the India-US bilateral deal will force India to buy more energy from the US to substitute from lower or nil imports from Russia.

Industry trends from the non-fossil fuel segments seem bleak. The optimistic projections given a few years back have turned out to be, well, highly optimistic. The International Energy Agency (IEA) estimated that a “widespread adoption of electric vehicles (EVs)… would undermine demand for (fossil) fuels, and a steady and accelerating shift to wind and solar for power generation” would undermine “demand for natural gas,” according to a media report. However, current trends indicate that EV adoption is slack, and investments in renewables may have peaked.

“EV adoption happened at a massive scale only in China, thanks to a steady and abundant flow of subsidies. Yet even that massive adoption of EVs did not lead to peak oil demand in China. It only contributed to a slowdown in demand growth. Elsewhere, EVs have struggled, with carmakers incurring tens of billions in losses, so now some are bringing back diesel models,” states the same media report. In India, for example, makers of EVs predict that adoption will be slow due to higher upfront prices, and other practical difficulties like recharging. Hence, there is a flood in launches of diesel and hybrid models.

Thanks to these developments, the IEA scaled down its prediction that crude oil demand will peak before 2030. The impression today is that there is a long road ahead, and crude use will continue to grow for a much longer time. Of course, such estimates from a globally-renowned agency forces the oil majors to drill more, and produce more crude oil and gas. As Russia seeks new markets because of sanctions, it proposes joint investments with large users like China to build new, longer, and massive pipelines to transport the crude and gas.

According to global analysts, Big Oil will think of expanding the crude oil reserves to expand production, with the minds on many more years of use left for fossil fuels. Instead of thinking short term, for which the prediction is of oversupply, Big Oil will think of the future, when crude demand will continue to increase, and perk up beyond 2030s. As one of them said, “We think investors are likely to focus more on growth than distributions going forwards.” In effect, finding new reserves, activating existing and old ones, and pumping money in drilling.

According to the media report, “The reserve replacement issue has been on the backburner in the past few years. This was because the supermajors were trying to reinvent themselves as low-carbon energy suppliers and traders, although their overall success in these ventures has been mixed. All this was done because the global analyst community saw no long-term future in oil and gas. Now reserve replacement is once again in the spotlight, because oil and gas do, in fact, have a long-term future.” It is back to drilling.

Consider the case of Shell. In a recent earnings call, the oil major’s chief executive lamented that the company walked away from Guyana. “If I were to look back, I wish we had not walked away… when we did,” he said. Of course, Shell seeks to explore more, and is “hungry for growth.” So are the American oil giants. The different phases of evolution across nations provides them with more freedom to decide and choose where to invest, when, and to what extent. Many nations may bend over backwards to accommodate the demands of the oil majors.

While Shell talks about inorganic growth via acquisitions and takeovers as the fastest way to grow, BP is making new discoveries, and announced a latest one last month. Norway’s Equinor, according to a report, is “planning a major international expansion to boost reserves.” It is ironic that this is the period when the financials of the oil giants are under stress, largely due to decline in global crude prices by a fifth. Yet, shareholders do not seem to mind, and there were no demands to scale down growth, drilling, and exploration despite lower dividends or buybacks. The shareholders want the firms to up investments.

“A year of upstream energy abundance lies in store in 2026, but with potential bottlenecks downstream. We can thus expect to see depressed primary energy prices, albeit with potential for healthy margins in some energy carrier and storage segments. However, the deeper primary energy prices fall in 2026, the more they will rebound in 2027 and 2028,” states a report by Rystad Energy. So, the short-term oversupply may give way to a bigger supply squeeze. This excites the shareholders of the oil giants. The stockholders believe that while the firms will gain from the squeeze, they will benefit further if they find new reserves, reactivate existing ones, and grow via acquisitions.