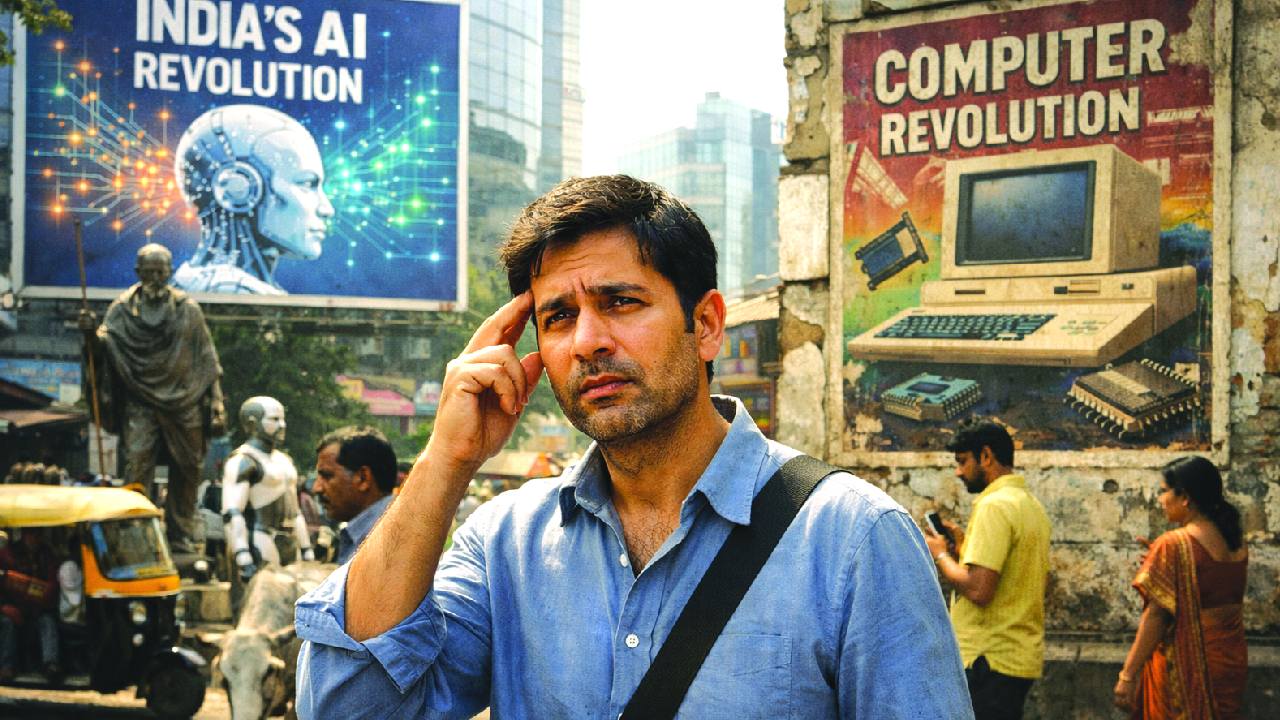

A strange sense of déjà vu in India’s AI moment

There is a strange sense of déjà vu in India’s AI moment. The confidence feels familiar, the ambition unmistakable. History, however, has a way of whispering warnings when excitement outruns economic stability. Artificial intelligence promises transformation — but past turning points suggest that the real consequences often appear later, and linger longer, than the applause.

India today speaks of AI with justified ambition. New models, expanding data centres, rising investment, and bold policy signals suggest a country eager to claim its place in the next technological order. Yet beneath the optimism lies a harder, more consequential question: can India integrate artificial intelligence into its economy without destabilising it? Buried in the Economic Survey 2025–26 is an important recognition: artificial intelligence is no longer just about faster productivity or smarter software. It is now influencing capital, jobs, and financial stability itself. Once AI begins to affect these fundamentals, the debate stops being technological and becomes unmistakably strategic.

India’s AI moment, therefore, is not about who builds the biggest model or deploys the most computing power. It is about whether the country can manage AI in a way that strengthens economic resilience rather than undermines it.Globally, AI is being built on an unprecedented scale. Large language models (LLMs) demand vast data centres, uninterrupted energy supply, and long-term capital commitments. To finance this expansion, companies have increasingly turned to complex financial arrangements — leveraged funding, special-purpose vehicles, and off-balance-sheet structures.

History has seen this pattern before. Technological revolutions do not usually trigger crises by themselves. Crises emerge when financial expectations race ahead of economic reality. The Survey openly notes concerns about the economics of large AI investments and warns that a sharp correction in AI infrastructure spending could spill over into wider financial markets.

In plain terms, AI is beginning to look less like a simple growth story and more like a systemic risk variable. For India, that distinction matters a lot. Our economy remains structurally sensitive to global financial cycles. Despite strong growth and improving fundamentals, the country runs a current account deficit and depends on foreign capital to finance investment and stabilise the rupee. When global investors become cautious — as they often do during periods of uncertainty — capital flows can reverse quickly. This explains a paradox many Indians have observed: why the rupee can weaken even when growth is robust and inflation is

under control. Markets today are not rewarding growth alone. They are pricing resilience, predictability, and shock-absorption capacity.AI, if pursued without macroeconomic discipline, can weaken that resilience. Running large-scale AI systems requires imported hardware, enormous energy inputs, and sustained access to global capital. A country that imports all three does not gain strategic autonomy; it accumulates vulnerability. When global liquidity tightens or geopolitical tensions rise, those vulnerabilities surface abruptly. This is the correction India’s AI narrative must confront: scale without stability is not strength.

AI as strategic power — and strategic exposure

AI infrastructure is increasingly concentrated — geographically, financially, and technologically. A small number of countries control advanced chips. A handful of corporations dominate cloud infrastructure and foundational models. Energy-intensive data centres are now critical nodes in national power grids.

These realities carry direct geopolitical consequences. In a world marked by sanctions, export controls, and technology weaponisation, dependence on external AI supply chains can quickly translate into strategic exposure. A disruption in chip availability, energy pricing, or capital flows can degrade a nation’s AI capability almost overnight. Unlike traditional industries, AI systems deteriorate rapidly when starved of compute, power, or data access.

This is why the Survey’s warning about AI-linked financial stress must be read alongside India’s broader strategic environment. A country that relies heavily on imported AI hardware, foreign capital, and overseas cloud infrastructure risks externalising its digital sovereignty. Economic instability, in this context, becomes a national security risk. Currency volatility, employment shocks, and sudden capital flight weaken strategic posture just as surely as conventional threats. Another assumption in the AI debate deserves scrutiny: that AI will naturally extend India’s services-led success. India’s IT and services sector has been a pillar of growth and foreign exchange. But services can bypass weak infrastructure and uneven governance. Manufacturing cannot. It forces improvements in logistics, power reliability, labour regulation, and state capacity.

This distinction matters. Countries with strong manufacturing bases tend to enjoy more stable currencies and deeper institutional resilience. AI, if confined largely to services and digital platforms, risks repeating an old pattern—productivity gains concentrated in narrow segments, while employment disruption spreads faster than new opportunities emerge.

AI will not automatically solve India’s jobs challenge. Without deliberate policy design, it may intensify inequality and social strain instead.

This is where the Economic Survey’s emphasis on an “entrepreneurial State” becomes crucial. This does not imply state control over technology. It implies state capacity to manage uncertainty.AI compresses time horizons, concentrates capital, and amplifies first-mover advantages. If the state responds late, adjustment costs fall on workers, small enterprises, and public finances. A serious AI strategy therefore cannot be written by technologists alone. It must involve economists, labour planners, energy regulators, and financial authorities working together.

AI is not just a technical shift. It is a political-economy shock. India still retains an advantage. Unlike several advanced economies, it is not yet over-financialised. Its AI ecosystem remains closer to practical deployment than speculative excess. This provides a narrow but valuable window to design an AI path that strengthens the economy rather than destabilises it. But that window will not remain open indefinitely. What would a stable and strategically sound AI approach look like?

First, AI infrastructure must be treated as national economic infrastructure, not a speculative arms race. Financial prudence matters more than speed. Excessive leverage today creates fragility tomorrow. Second, AI deployment should prioritise sectors that strengthen India’s economic foundations — manufacturing productivity, logistics efficiency, energy management, agriculture, and public service delivery. These improve competitiveness and reduce external vulnerability. Third, AI policy must be integrated with employment, skilling and social protection systems. Ignoring labour disruption does not prevent it; it merely postpones the cost. Finally, India must abandon the illusion that AI leadership is measured only by technological scale. In a fragmented and fragile global order, stability itself is a strategic asset.

The temptation to chase headlines will be strong. Bigger models, larger data centres, louder announcements are easy to celebrate. But nations do not rise on spectacle alone. They rise on discipline, institutions, and long-term thinking. India stands at a critical juncture. It has growth momentum, reform capacity, and the opportunity to integrate AI thoughtfully rather than reactively. The choice is between speed and strategy, between excitement and endurance.

The sense of déjà vu surrounding India’s AI moment is not a reason for hesitation. It is a reminder. History rarely repeats itself exactly — but it often sends warnings first. Whether India listens will determine whether artificial intelligence becomes a source of lasting strength, or the next great stress test.

Author is a theoretical physicist at the University of North Carolina at Chapel Hill, US, and the author of the forthcoming book The Last Equation Before Silence; views are personal