Irrespective of the nature of business and sector affiliation, they are structured to result in concentration of income in the hands of owners

According to the Oxfam report, “Inequality Kills’’, released ahead of the World Economic Forum’sDavos Agenda early this month, the collective wealth of India’s 100 richest people in 2021 hit a record high of `5700,000 crore ($775 billion) while the number of Indian billionaires grew from 102 to 142. During the pandemic, the wealth of these billionaires increased from `2300,000 crore ($313 billion) in March 2020 to `5300,000 crore ($719 billion) in November 2021.

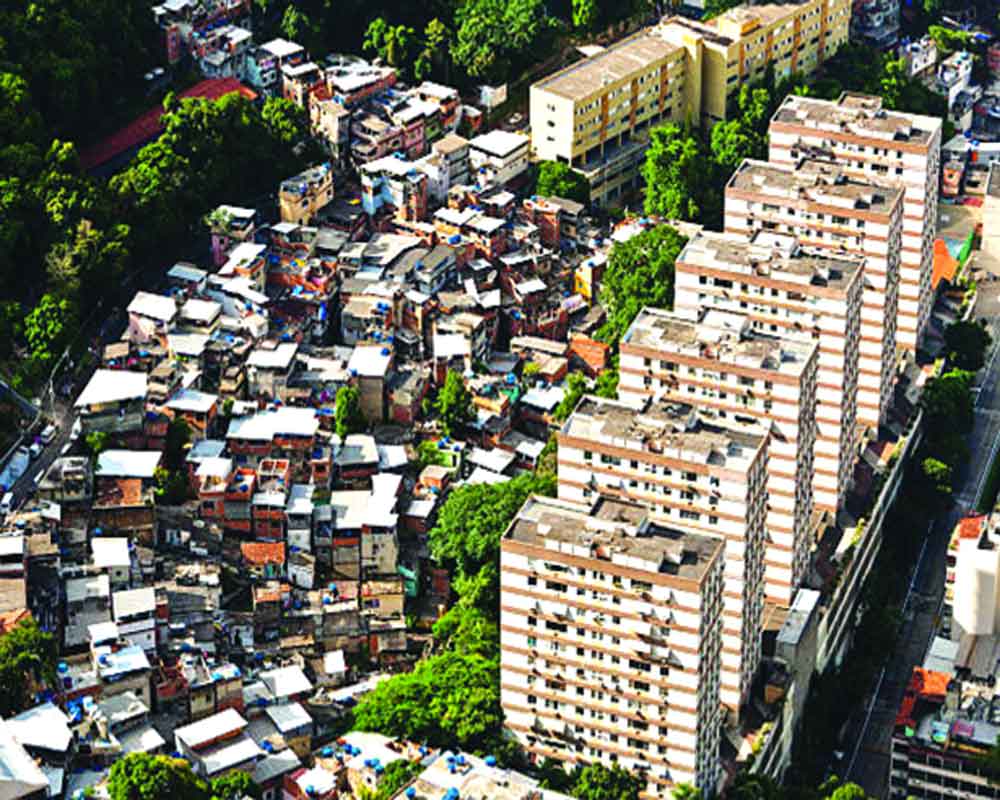

At the same time, the income of 84 percent of households declinedand the share of the bottom half of the population in national wealth was a mere six percent. More than 46 million Indians are estimated to have fallen into extreme poverty in 2020, nearly half of the global new poor.

Lest one gets a sense that glaring inequalities have arisen only because of the pandemic,the fact remains theyexisted even before.

A report ‘Time to Care’ Oxfam ahead of the 50th Annual Meeting of the WEF during in January 2020 said ‘India’s richest one percent hold more than four-times the wealth held by 953 million people who make up for the bottom 70 percent of the population. Further, the combined total wealth of 63 Indian billionaires is higher than the total Union Budget of India for the fiscal year 2018-19.

The income of persons is inextricably linked to a country’s GDP. The inequalitiesin income can arise under two scenarios: (i) Rising GDP --income of majority of the population increases at a much slower pace than the increase in income of one percent sitting on top of the pyramid. (ii)Declining GDP --income of the former declines at a much faster pace than decrease in income of the latter.

While the second scenario comes up once in a blue moon, the first is pretty normal. To get a sense of what would be happening, let us consider this. If GDP increases by a rupee, an overwhelming share say 80 paise goes to the top one percent whereas the bottom 70 percent gets six paise (remaining 14 paise go to peoplein the 71-99 percent range).With this highly skewed distribution, even if GDP increases by `10, the top one percent will get away with `8 while the bottom 70 percent would be left with a meager 60 paise.

The protagonists of high growth would make us believe that everything is honky dory, but the fact remains that its benefits are appropriated mostly by a few persons at the top even as majority of those at the bottom of pyramid get very little.

This is something intrinsic to the way businesses are planned and orchestrated.It all starts with the government offering a policy environment in which investors are offered an opportunity to earn an attractive rate of return on investment. What should be that attractive rate, this is not normally defined (though in certain sectors like power, fertilizers, it guarantees a minimum return); so any level howsoever, high can fall within the scope of ‘attractiveness’.

A number of big businesses enjoy pricing power. For instance, those operating in metals such as copper, zinc, aluminum or in hydrocarbons like oil and gasenjoy natural monopoly. Leveraging this, they charge high prices making windfall gains. This also applies to private banks who enjoy margins of 3-4 per cent yielding mammoth profits. There are companies in the IT and IT-enabled sector which use their intellectual prowess to post huge profit year-after-year.

Enterprises in the chemical, petrochemicals, pharmaceutical and agrochemicals sectors have hugely benefited from a protective policy environment with high tariff on imports as well as licensing and registration requirements. They make money at the expense of millions of consumers including farmers.

The owners/promoters of these businesses also leave no stone unturned in ensuring that their tax liability is kept at bare minimum. The government is also more than willing to help them in their zeal to maximize profits (look at the steep reduction in corporate tax rate to 15 per cent for new enterprises and to 22 per cent for existing entities given in September 2019).

Most of these being capital-intensive and skill-intensive industries, the employees benefiting from profit sharing are miniscule in the country’s workforce of over 500 million. On the other hand, labor intensive sectors such as textiles, apparels, footwear, food service, and hospitality provide jobs including to un-skilled workers on a large scale. But it is unlikely that these workers get a good share in the pie.

Over 60 million small and medium enterprises (SMEs)are privately owned businessesalsoape large enterprises when it comes to distributing the proceeds of wealth generation. Their owners spend the least on payment to workers thereby boosting their earnings.

The other important job provider is agriculture. Here, mostly farmer is the owner as well as cultivator/worker. Tens of millions of them are at the mercy of a handful of traders.The latter buy crops from the former at throwaway price (MSP notified by GOI remains mostly on paper) and sell to the consumer at high price.

There is yet another class of rich which feeds itself on misuse of public resources. This includes corrupt bureaucrats, politicians and middlemen, who amass wealth disproportionate to their known sources of income by siphoning off funds from welfare schemes,diversion of loans taken from public sector banks (PSBs)to shell companies of which they are the ultimate beneficiaries etc.

Briefly put, irrespective of the nature of business, big or small, or sector affiliation like agriculture, industry, services or trade, all are structured to result in concentration of income in the hands of their owners or those who wield power and influence. The working class especially in the SMEs as also millions of farmers and landless farm workers are at the receiving end.

Even the benefit of tax concessions to corporate and SMEs end up filling pockets of the top few. At another level, numerous welfare schemes (free food, free gas connection, subsidized fertilizer) run by them barely help the majority of the poor survive.

There is need for a fundamental change in the way our industrialists do businesses and politicians and bureaucrats conduct themselves. While, the former need to shed their overzealousness for profits, charge less from consumers, distribute more to workers and pay more taxes, the latter must ensure that every rupee is spent for the welfare and empowerment of the poor.

A group of more than 100 billionaires — branding itself as “Patriotic Millionaires” — has issued a plea to political and business leaders attending the WEF (2022) to make us pay more tax (presumably, it includes Indian billionaires). This is laughable; first, they create systems leading to self-aggrandizement at the cost of a vast majority and then pretend they care for the latter.

Will these self-proclaimed patriots pledge not to fleece the vast majority of the poor in the first place?

(The writer is a policy analyst. The views expressed are personal.)